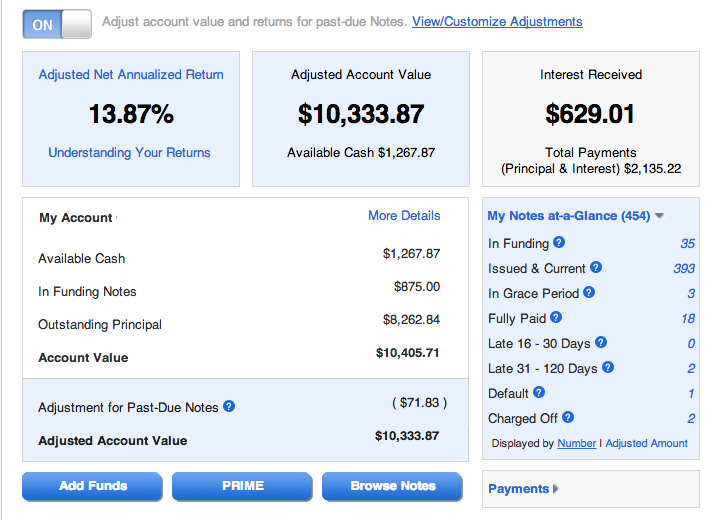

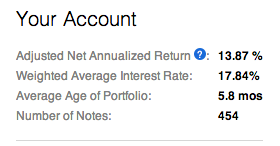

It has been awhile since I’ve had a post outlining my returns with p2p lending and my plan is to be more consistent with these posts in the future. I want to preface this with the fact that my Lending Club notes are still not seasoned which means my returns below are not an accurate representation of what they will be. In fact, I have seen little progress in the average age of my notes as I continue to add funds to my account. I have finally seen my first defaults and charge offs come through. The adjusted net annualized return calculation from Lending Club puts my returns at 13.87%. If you’re curious, starting in 2014 I also started tracking my returns with XIRR. As of March 31, 2014 my returns were 15.43%.

You’ll also notice the high amount of available cash which is due to the fact that I recently put my tax return into my Lending Club account. Since it has only been a few days, I have yet to bring my available cash down to a reasonable amount. With this addition, I have surpassed $10,000 in my Lending Club account up from my original investment last year of around $2,500. As I continue to save a large percentage of my income, I will continue to add to my account. Additionally, I recently added $1,000 to my account to invest while I was on vacation which is also the reason for the high amount of notes in funding.

My average age of my portfolio is 5.8 months. This number has actually decreased in the last month even though I have almost had my Lending Club account open for a year. This is simply due to the fact that I keep adding to my account as mentioned earlier. 56 of my notes were purchased using a FOLIOfn strategy and although it is a small amount of my portfolio it certainly can skew these numbers.

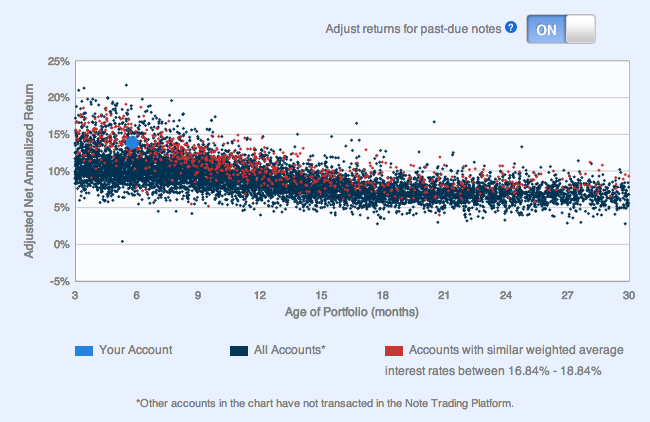

Below is where I fall within Lending Club’s chart mapping out returns over time. I fall right in the middle of my peers with similar weighed average interest rates and I’ll be curious to see the progression.

I’m happy with what I’m seeing so far, even if my returns drop a few percent as notes season. My portfolio update posts will be much more valuable as time goes on. Please feel free to share your thoughts in the comments.

shuhai says

Bravo

shuhai says

Hi, Ryan, do you keep track of the durations of notes went to defaults and charge off? How many days in average they went to defaults and charge off? for the notes that charged off, what are the similar features they possess ? Thanks.

Shuhai, at this point it is hard to draw any valuable conclusions from my notes in default or charged off. Between the two that have charged off and one that has defaulted one of them is a 60 month grade F note. The others are grade C and E - 36 month notes. They have had between 2-6 successful payments until they stopped paying. Although it is important to keep an eye on notes that go eventually charge off, at the end of the day it is just the reality of p2p lending (especially when it comes to a higher grade note strategy) We have to focus on what we have control over - which is note selection. I feel confident in my current strategy and this industry as a whole which is why I continue to add my account. I also make sure to keep diversified with my overall investment portfolio. I’m looking forward to see my returns when my notes are officially seasoned.

shuhai says

Thanks you, understandable. Excellent points.