This is part 3 of a series of guest posts from New Jersey Guy who is an active member on the LendAcademy Forum. He is located in New Jersey as his name suggests so he is not currently able to invest in notes directly through Lending Club. However, he has decided to share his secrets on investing in FolioFN - the secondary market for Lending Club. There will be 4 posts in this series that will outline 3 of his strategies that can help you break the mold for better returns with Lending Club.

Strategy #2: Speculate on Current Notes.

A second tip is purchasing “Current” notes at a discount with the intent of reselling.

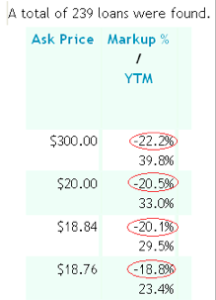

I like this strategy, and it works. The investment per note is affordable, notes turn fairly quickly, and the risk is nominal. However, in order to get those discounts, the notes you will be buying are what are called “Late to Current”. Typically, these are notes that have had past payment problems but recently gone “Current”. You can find these notes at discounts of 15% or better. Stay on top of it, and you’ll find many at 20% or even more. The whole idea here is to buy at a discount and SELL at a discount. Let’s look to see how this works.

Today, you find a note that has $22 remaining principle. You buy it for a 20% discount or $17.60. Tomorrow, when the note settles, you relist the note at a 3% discount or $21.34. Two weeks later, the note sells. After Folio fees, you make $3.70 in capital gains.

Today, you find a note that has $22 remaining principle. You buy it for a 20% discount or $17.60. Tomorrow, when the note settles, you relist the note at a 3% discount or $21.34. Two weeks later, the note sells. After Folio fees, you make $3.70 in capital gains.

Sell 20 notes like this next month and you’ll net $74. If you concentrate on making this your only other “Alternative” strategy, and go totally gung-ho, you can make an extra $100 to $200 per month. To push that $200 mark, you’ll need to buy/sell approximately 65-70 notes per month. That means you need to build an inventory of about 90 to 110 of these notes. It’s tough to do, it might take 2-5 months, but if you stay on top of it and remain determined, it can be done.

Here is one piece of advice I will give you when choosing notes. The older the loan, the better. Try and avoid loans less than 3 or 4 months old. If the borrower is already late on payments 2 months into their loan, that’s a pretty bad sign, and probably explains why it’s up for sale so cheap. The odds of the loan to continually go south are fairly high.

So what happens to the notes you don’t sell inside of a month? At best, you’ll make interest payments. At worst, they fall behind again. In any case, be prepared to hold some notes for a while. If a borrower continues to make on-time payments say for 3 months, you collect the interest. But what happens is that the value of that note does increase slightly. So if the borrower begins to show a positive payment pattern, you can list that note at a 1% discount, or maybe even par. Stick to your guns. Somebody will buy it.

If the note falls behind again, you have two options. The first is reducing the price of the note to what you paid for it while it’s in Grace Period. The second is to remove the note off the market, and give the borrower a chance to make good. Many borrowers are habitual “Grace Period” or “Late Payment” Payers. You can kind of determine this by looking at their payment log. For example, if you see that in the last 12 months that the borrower has 4 “Grace Period” payments, you have a pretty good chance of that note coming around again. It’s not until a borrower misses 2 straight payments that you can conclude you have a problem note.

Leave a Reply