By now you’ve probably seen my returns in peer to peer lending as well as some of the other bloggers in this space (Peter, Simon). Today, I’m happy to feature Carl who I got to meet at LendIt this year. He has over 300k invested in Lending Club and his returns have been hovering above 11% using XIRR for 2014. (If you’re interested in calculating your returns this way - check out this video) Carl also began to sell his notes on FOLIOfn and it will be interesting to do a follow up early next year to see how his returns were affected. It’s always nice to get a different perspective on things and certainly Carl isn’t the average p2p lending investor. In fact, he doesn’t employ any automation to pick his notes. Every note is hand picked. Take it away Carl!

I am an avid reader of The Wall Street Journal. When I read about Prosper in 2007. It seemed like a worthwhile investment. To be polite, like many others, my experience with Prosper I was not a happy one. When Prosper II appeared I decided to bite the bullet and invest. Much happier experience. But then I noticed an increasing scarcity of high yield notes. It was then-in 2012-that I started with Lending Club.

Peer to peer investing is tax inefficient. While you have interest income, the deduction for capital losses (charge offs and any net losses in FOLIO) is capped at $3,000 per year. Fortunately we (my wife and I) can partially offset this inefficiency thru real estate investments. When you sell real estate investments the depreciation you have taken and any gain in property value are capital gains which can be offset by capital losses carried forward.

The ideal technique for dealing with the tax inefficiency of peer to peer lending is an IRA. While I have an existing IRA it is not invested in peer to peer notes. Unfortunately I am at the stage in life where I am forced to take annual distributions from my IRA.

I manually pick notes. Yes, it is time consuming but I am retired and can be on line several times a day when Lending Club makes notes available. The filters I use are: Interest rate, delinquencies, months since last record, minimum length of employment, maximum debt to income ratio. I also use FICO in conjunction with other factors in the note. My style of investing might be characterized as “synergistic”. I try to keep an open mind. For example what do you think of someone with a $2,500 monthly income? Well its 30K a year. But where does that person live? 30K a year in New York City does not go very far. But what if the individual lives in Meridian Mississippi? The cost of living there is much lower. Then what is the income of others in the household? We don’t have an answer to that but we do know the approximate age of the individual. Generally younger folks have a lower income than someone in their prime earning years. Another factor: does the loan make sense? If the person rents (And I do not hold that against them) they should not request a loan for Home Improvement.* If they do, that’s a red flag. There are numerous other variables that come into play and each loan must be individually analyzed.

I am partially reinvesting my interest and returned principal. I am at a slow growth stage. At this time I am not looking at other p2p companies to invest in.

One of my major concerns is prepayments. The FICO data in Peercube enables me to deal with a borrowers’ FICO deterioration and resultant possible charge of. For prepayments I do not know of any predictive factor(s). Prepayments force the investor to reinvest, which in turn guarantees dead money until the first payment is received.

Finally the size of my loans. I started out at the $25 level and now invest at the $100 level. I concur in the advice to start slow at $25 a note. While you should carefully analyze notes (if you don’t automate your investments) don’t overdo it. And you will have deficiencies and eventual charge offs.

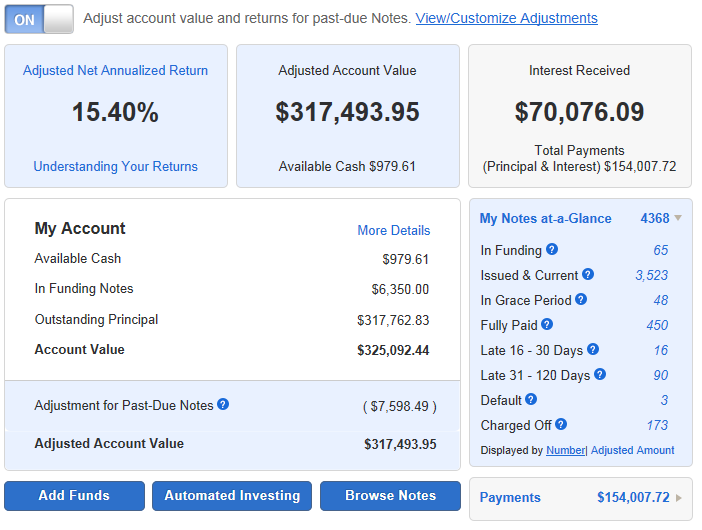

Carl’s account by the numbers:

22.86% Average Interest Rate

~11 Months Average Age

4000+ notes

Additionally, you can see a snapshot of his account below:

*Here is a link to Nickel Steamroller for Home Improvement loans for folks that rent

http://www.nickelsteamroller.com/#!/link?l=7cf6c3f5fcac26c38621bbcb6e6e0a42

Alternatively, look at the different if I change the filter to Mortgage and Own.

http://www.nickelsteamroller.com/#!/link?l=a01a8125df77433756500c1a65c14533

Further Reading: Carl also recently posted on the PureCube blog.

If any of you have any comments or questions for Carl, feel free to leave them below.

[…] Betting Big on P2P Lending – Another Reader’s Returns from Peer & Social Lending - This large investor in both Lending Club and Prosper shares his thoughts and strategies. […]