Todays post is by Chris Grundy of Bitbond. Chris is a Bitcoin obsessive and avid p2p lending fan who has written for a variety of Online publications as well as regularly contributing to the Bitbond blog. You can follow him on Twitter or connect with him on LinkedIn. Any feedback is welcome and encouraged.

It is fair to say that the p2p lending industry is having a stellar year. As you will be aware, Lending Club reported an extremely successful Q2, breaking through $1.9 billion in originations in that quarter alone. During the same time period, Prosper issued a staggering $912.4 million in new loans, representing a 147% increase year-over-year!

The U.K. is equally as impressive with $792 million being lent over p2p platforms in Q2 according to the Peer-to-Peer Finance Association.

So how can you take part and profit from the p2p lending boom?

Well, the first thing you need to do is find the right peer to peer lending site for you, in order to start investing and saying goodbye to the 2.5% interest offered by your bank. Below, I have listed my favourite peer to peer lending sites from around the world for you. Have a look and let me know in the comments if you think I have made any glaring oversights. Enjoy!

Will only focus on peer to peer lending sites and not Marketplace lenders. Thus, not included: Kabage, OnDeck, SoFi, Funding Circle

Global

Bitbond

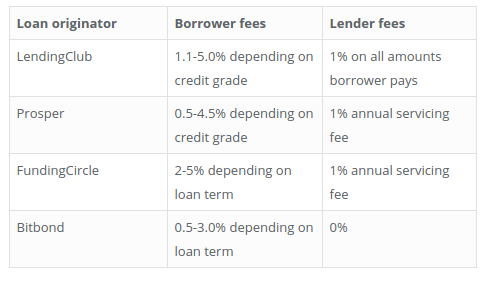

Using bitcoin as a payment network, Bitbond gives investors access to higher interest rates from around the world at zero fees. Below is a table comparing fee structures across platforms.

Besides the minimal fees, Bitbond offers is the AutoInvest tool (video) which allows larger investors to set clear investment parameters and then automate the investment process, saving time as well as money.

Potential bitcoin investors might also be won over by the weekly borrower interviews which are published on the company blog, and allow lenders to read up on the people they might want to invest in.

The average interest rate on Bitbond currently stands at 25% and you can invest as little as $2.50. Check out Stu Lustman’s quarterly returns reports to see a comparison between fiat and bitcoin ROIs for lenders, and have a look at one of the most lucractive bitcoin affiliate programs around.

The U.S.

1. Lending Club

I think it is fair to say that Lending Club is the favourite among U.S. peer to peer lending sites. Industry heavies such as Simon Cunningham (Lending Memo), Peter Renton (Lend Academy) and Ryan Lichtenwald from this very blog (and Lend Academy), have all extolled on the platforms virtues and have recorded their impressive ROI’s, coming in at 13.3%, 11.30% and 10% respectively.

I think it is fair to say that Lending Club is the favourite among U.S. peer to peer lending sites. Industry heavies such as Simon Cunningham (Lending Memo), Peter Renton (Lend Academy) and Ryan Lichtenwald from this very blog (and Lend Academy), have all extolled on the platforms virtues and have recorded their impressive ROI’s, coming in at 13.3%, 11.30% and 10% respectively.

Average investors can expect to enjoy a healthy ROI of 6-8%, which might seem a little disappointing when compared to the professionals, but should nevertheless be considered very attractive.

Lending Club also let you invest $25 per investment which makes it possible to further diversify a smallish investment total, and have a very good credit scoring system in place.

2. Prosper

Prosper suffered a rocky start. Not controlling pricing in the early pre-crisis years really hurt their returns in the critical 2006-08 period. Prosper also fought the SEC on who should regulate the industry and paid greatly for it. Having put this behind them however, the peer to peer lending platform has enjoyed explosive growth in recent years.

This growth comes mainly from Prosper’s newly acquired reputation as being a very solid way of earning extra cash. Since 2006, they have paid more than $140 million to their investors, with average ROI ranging between 5-9%. Additionally, Prosper’s evaluation of borrowers and the subsequently high quality of loan requests has helped build their reputation as a safe haven for investors. Specifically, their average credit score for borrowers is an impressive 700.

3. Upstart

Upstart might not have the same loan volume of the two giant peer to peer lending sites in the U.S. but it has some interesting characteristics that may well make it intriguing for investors. One of the biggest bugbears p2p investors usually have at Lending Club and Prosper is that when a loan defaults it is the investors, not the platforms that take the hit.

With Upstart’s approach, if a loan defaults at any time over the course of the loan term, then Upstart will take the revenue they earned from the origination fees and refund the money to investors.

Upstart’s origination fees range between 1% and 6%, which may well prove an attractive remuneration for peer to peer lenders who have seen an investment go south.

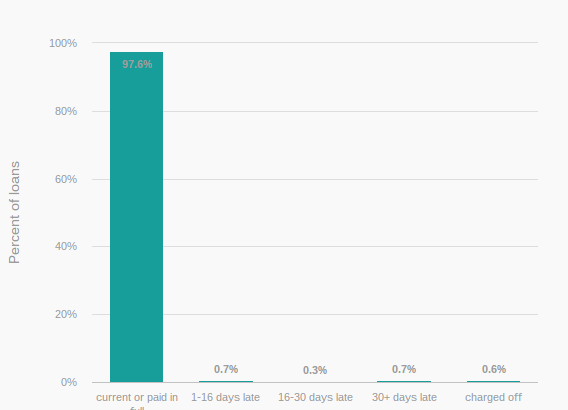

A further feather in the p2p lending platforms cap, is the impressively low default rate which can be explained by extremely tough admissions process for borrowers

With this in mind, expected ROI for investors is significantly below the previous platforms, coming in at 4-8%.

4. Peer Form

Peer form is one of the oldest peer to peer lending sites on this list, despite only coming to prominence recently with another successful round of funding. Special features of Peer Form include their emphasis on accredited or institutional investors and their focus on three-year loan terms. Interest rates stand between 7-28% with over 14 different loan grades.

Borrowers must have a minimum FICO score of 600 in order to apply for a loan, and as of today, there are about 70 loans on the platform with a majority of these commanding 20%+ interest rates.

5. Kiva

Kiva came up with a really good social idea. It is an US non-profit organization with the mission to connect people through lending, with the main goal of alleviate poverty. Kiva was founded in 2005 and has up to 1.382 lenders in 83 different countries.

In just 5 years, Kiva has distributed over $240 million borrowed by more than 620,000 people around the world, contributing to the improvement of about 615,000 lives. Of that borrowed amount, only about 1.58% has not been fully paid back.

Kiva’s work is pretty interesting. It works with microfinance institutions all around the world - whom they call Field Partners. One of the reasons why this project is so successful is related to the fact that one can only donate as low as $25.

India

1 Faircent

Founded in 2011 by Rajat Ghandi, Faircent aims to provide credit on demand for all Indians. Having aced the lender acquisition in recent years, Ghandi now states “today our challenge is to provide credit-worthy borrowers to our over 2,500 lenders.”

It seems like Faircent is up to the challenge, raising $250,000 in a pre-Series-A funding in June, and recently raising an undisclosed fee from Mohandas Pai. Perhaps unsurprising considering that 78% of Indian population does not have access to personal loans from banks or NBFC.

Since it’s inception, Faircent has processed over 300million Indian Rupees, around USD4.6million and boasts average interest rates of over 20%.

2. i-lend.in

In India, asset classes are few and tightly managed from a risk/return perspective, and not many asset classes exist where high earnings can be made. The returns on peer to peer lending sites like i-lend represent a welcome change therefore, bringing in between 16% to 20,75% on average.

With this in mind it is important to note, that peer to peer lending is still unregulated in India, meaning that lenders have much less protection here than in other regions covered on this list.

Additionally, fees for lenders on i-lend are 1.5% of the invested amount and there can be numerous factors to consider before investing as explained here on p2p-banking.com:

A typical P2P transaction involves multiple lenders lending to one borrower. In case the lender changes his mind about lending or there are delays in collecting cheques (lenders can be based anywhere in the country), the borrower may not get their money on time – this can be weeks, sometime months.”

That being said, p2p lending clearly has a huge amount of potential in India.

Europe

1. Bondora

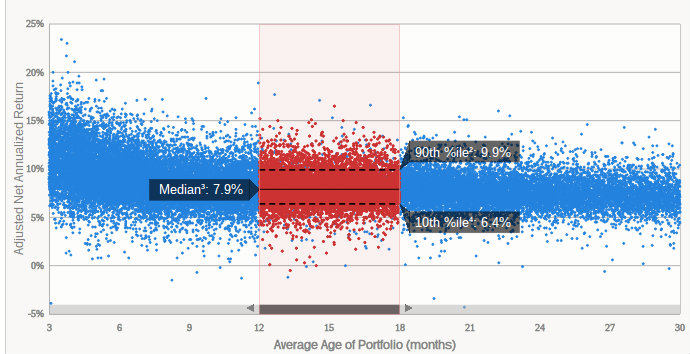

Bondora is one of the most exciting peer to peer lending sites out there today. This is because of its documented high yield returns for the 9,000+ investors who have signed up.

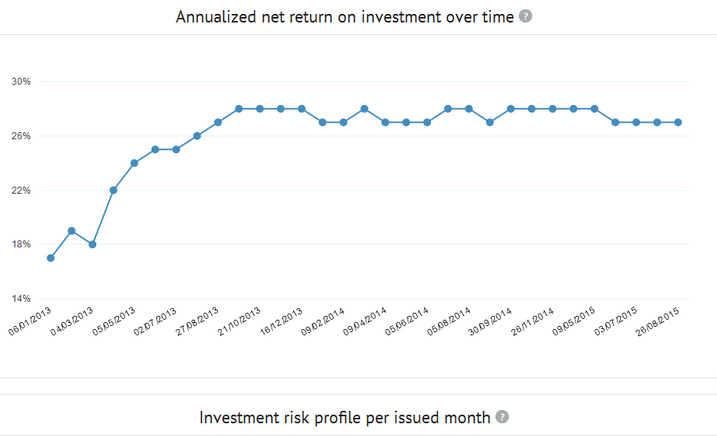

Perhaps the most prominent among these is Claus Lehmann, (wiseclerk) author of p2p-banking.com, who has documented his returns from the European p2p lending platform. Below is a screenshot of his returns in which he showcases his average of 26% ROI on Bondora to date.

Bondora has issued over €45 million in loans since 2009 and serviced over 100,000 borrowers across 3 countries.

2. Prêt d’union

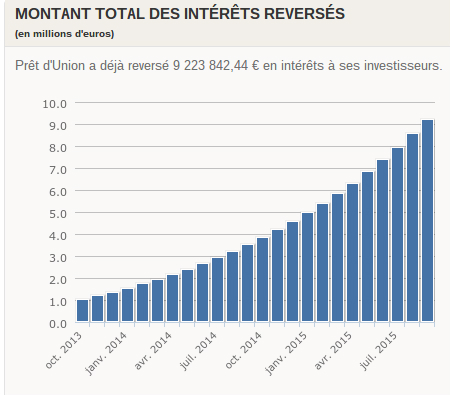

Prêt d’union, founded in 2009, has become the largest peer to peer lending site in France, having granted €228 million in personal loans so far, and paid out over €9 million in interest to investors.

Having grabbed $34 million from Eurazeo, Pierre Kosciusko-Morizet as well as existing investors in July of 2015, Pret d’Union is perfectly placed to expand into the rest of Europe and become the continents dominant force.

Interestingly, the French peer to peer lending platform offers lenders 4 types of investments which are:

- Conservative & short duration

- Conservative & long duration

- Balanced & short duration

- Balanced & long duration

Yields for lenders are superior to those offered by banks, but mild in the p2p lending climate at 4-7.5%. For more information check out this interview with CEO Charles Egly.

3. AuxMoney

Aux Money is currently Germany’s biggest peer to peer lending site, which has reportedly financed over 32,000 loans totalling a volume of more than €180 million, since its inception in 2007.

Despite the relatively low loan volume, when compared to it’s US counterparts, Aux Money is perhaps the most dominant regional p2p lending platform in the world, with a study (untertaken by Händlerbund) suggesting that the German lending giant commanded 2/3 of the domestic market.

Investors can expect to pay 1% of their invested amount as a fee to Aux Money, while borrowers pay €2.50 a month plus a one-time fee, 2.95% of the total borrowed amount.

Returns for lenders average 6.7% per annum, with investments usually ranging between €3,500-€4,500. Interestingly Aux Money has an acceptance rate for borrowers of 20% meaning that only 400 of the 2000 daily applicants are accepted and are allowed to publish a loan.

Good news for the roughly 13,000 active investors.

4. Lendico

Lendico is a Berlin-based peer to peer lending site which was founded in 2013 by the ubiquitous German incubator Rocket Internet. Having expanded to Spain, Poland, Austria, South Africa and the Netherlands, you could argue that Lendico is the first multinational p2p lending platform.

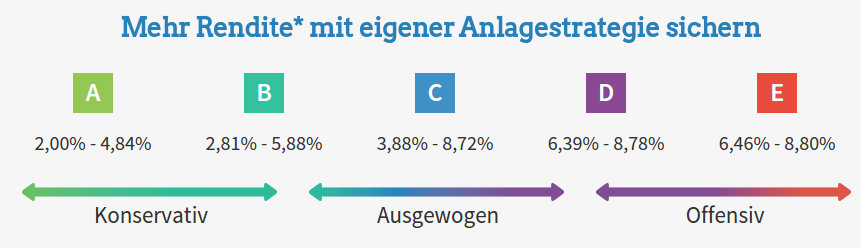

Loans on the platform are SME or personal loans and fall somewhere between €1,000-€150,000 in Germany. As on many other platforms, the perceived creditworthiness of the borrower determines the interest rate he has to pay, and the subsequent ROI investors can expect.

At present interest rates can be considered mild in the current climate, starting at 2% and climbing to 8.8% for the highest risk borrowers.

6. Zencap

Zencap is another great example of the rude health of the European peer to peer lending industry, having raised €230 million in investments from Victory Park Capital in June of 2015.

Flush with cash, Zencap now aims to provide small and medium sized business located in Germany, Spain and Netherlands with €5,000 to €250,000.

Intriguingly, Zencap is another Rocket Internet company, meaning it is in direct competition in the p2p lending space with its sister Lendico. For investors, loan terms range from 3 months up to 5 years, with the latter being the backbone of the business.

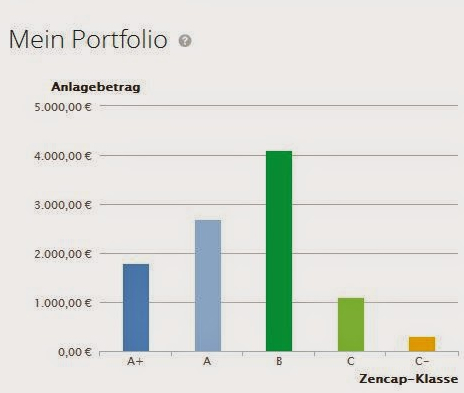

Experiences on the platform seem to be mixed, as German investor Martin R. explains in a guest post for p2p-banking.com. With yields of around 5.7% Zencap will have difficulty competing with alternatives such as Bondora, Aux Money. Below you can see a screenshot of his portfolio diversification across credit ratings.

Martin, despite his diversification, like most other investors on Zencap, did no experience any defaults on his investments. With a relatively week ROI however, this might be expected.

7. Cashare

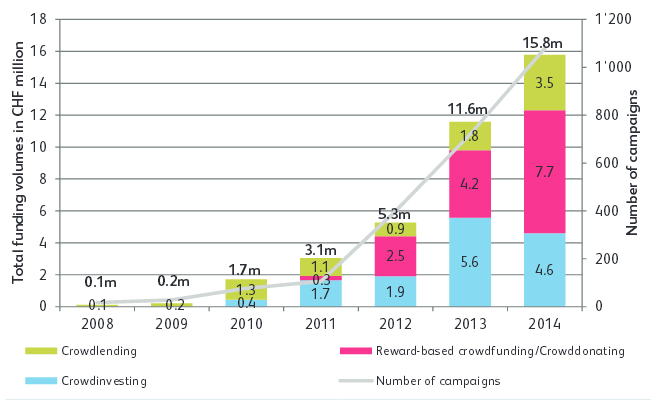

Cashare is the leading platform in the expanding Swiss p2p lending space, which grew by a respectable 36% in 2014.

Interest rates on the platform usually lie between 7.7% and 9.9% with 58 loan requests currently available for investment. Additionally, Cashare supplies loans to applicants with varying purposes, whether to finance their education, pay their medical bills or hire a nanny, meaning that lenders can find higher interest rates if they wish to up the risk.

8. Smava

Having raised close to $30 million in several funding rounds, Smava is the up and coming peer to peer lending site in Germany, despite being a presence in the space since 2007.

Since then the German p2p platform has facilitated over €150 million in loans, with an annual ROI for investors of around 6.7%. Smava has a couple of cool features which make it interesting for investors such as the “bidbot” (Bietmaschine) which can be set to invest your money automatically along parameters you choose.

Unfortunately, Smava has the highest fees for investors I have seen in Europe. 1.35% of the total invested amount is taken off as a fee. Borrowers can expect to pay 2.5-3% as a fee.

9. Mintos

Mintos is perhaps one of the most exciting peer to peer lending platforms in Europe today. With over 2651 registered investors and bosting an average ROI of 12.86%, Mintos is definitely seem to be making all the right moves.

What makes Mintos special, is its use of collateral. As investor Marco Schwartz wrote in his guest post, every loan is attached to collateral, meaning that if a borrower should fail to repay, whatever item he or she placed as collateral will be taken to reimburse the investors.

Interestingly, Mintos also offers to buy certain bad loans back from their investors. Thus, if you invest in one of the specified loans, and the borrower defaults, Mintos will buy back the bad debt at a reduced price, but leaving you a little less out of pocket.

10. Smartika

Smartika is a p2p platform that was founded in Italy in 2008. Back then the p2p lending system was not well ![]() understood and well seen by banks and institutions in general. It took Smartika four years to get the right regulation and finally at 2012 it was a fully licensed Payment Intermediary, authorized by the Bank of Italy to operate in the p2p field.

understood and well seen by banks and institutions in general. It took Smartika four years to get the right regulation and finally at 2012 it was a fully licensed Payment Intermediary, authorized by the Bank of Italy to operate in the p2p field.

The italian platform is now doing quite well: they just exceeded 20 million loans, with an average rate of return of 6% and about 5,791 active lenders. In an interview, Maurizio Sella, CEO of Smartika, talked about his beliefs on the exponentially growth potential of the italian p2p market.

11. Prestiamoci

Prestiamoci is another italian p2p platform, founded in 2014 and also authorized by the Bank of Italy to operate in the p2p field. The platform has already funded about 175 thousand euros, with the average revenue margin of 4%. For now, Prestiamoci has more than 450 lenders and disbursed 360 loans so far.

The startup is supported by Digital Magics, an italian business incubator. Responsible for investing on Prestiamoci and for providing strategic support to it, the incubator has accomplished a gain of 300% on the transaction.

U.K

1. Zopa

Zopa will always be the first peer to peer lending platform! A pioneer in the field, the UK-based website has seen losses increase in 2014 however, despite a sharp rise in revenue. Still, Zopa’s importance for the UK p2p lending ecosystem can not be overstated. They processed $408 million worth of loans in 2014, which makes their European counterparts pale in comparison.

With current monthly returns for investors of 0.7% to 0.8%, Zapo is still a little away from the 9% ROI their CEO aspires to.

2. Rate Setter

RateSetter has had a stellar 2014 and is now the largest peer to peer lending platform in the UK, processing over €400 million in 2014 alone. Backed by the star fund manager Neil Woodford, RateSetter has doubled its revenues in the space of a year.

Boasting an annual return of 6.1% to investors, it might be a little difficult at first to see how the platform has enjoyed such explosive growth. If you keep digging however, you quickly realise that the low interest rates are indicative of the safety (low default rates) experienced by lenders throughout the 6 year loan terms.

With the long loan terms in mind, we may well see a upward correction in default rates on RateSetter, as loans mature and default probabilities rise. Until then, RateSetter will stay a force to be reckoned with in the UK peer to peer industry.

3. Assetz Capital

Assetz Capital is one of the UKs leading peer to peer lending sites, with over 10,228 registered investors on the platforms. Having just exceeded its fundraising target of €2.5million in May of this year, and recording 300% year on year growth, Assetz Capital looks to have a bright future ahead.

What makes Assetz Capital special, is its focus on providing loans to SMEs and property developers in the UK. Consequently, the p2p lending site focuses on larger loans averaging around 400k.

For investors, attractive interest rates hovering between the 8-15% mark, promise healthy ROIs. Additionally their “underwriting team always takes security so that if there was a default, the assets takes as security should comfortably cover the value of the loan.”

4. Thincarts

Thincats is a p2p lending platform that operates throughout the UK. As many other platforms in this list, they also consider themselves as a good alternative to high street banks. Thincats was founded in 2011 by Kevin Caley, Peter Brown and Paul Meier, as sort as a response to the banking crisis that began in 2008.

The british platform has already raised up to 146 million pounds in loans. Borrowers can get loans from £100,000 to £3,000,000, and terms from 6 months to 60 months; and lenders must invest at least 1,000 pounds in a loan - and there is no maximum investment amount - with an average interest of 9%, meaning they should receive an attractive return on their investment.

Although having an elite public, Thincats seems to be trustworthy with high quality control.

Latin America

1 Fairplace

On the one hand, we should remember that back in 2010, Fairplace arrived with a bombshell in Brazil. It was the first p2p lending service in the country and it has processed around 2.5 million Reais, offering good interest rates and several tax benefits when compared to Brazilian banks.

Nevertheless, the platform faced an investigation by the Federal Police, who claimed that Fairplace had violated a brazilian law which prohibits companies that are not financial institutions to operate in financial markets.

Its founder Eldes Matiuzzo explained that his company did not provid loans, but instead offered a platform to connect borrowers and lenders.

2. Biva

Following in Fairplace’s footsteps, Biva is the second major brazilian p2p platform, founded in 2015. It connects companies who need working capital with people willing to invest in them. The platform facilitates loans from R$2,000  up to R$50,000 for 6, 12, 18 or 24 months. For borrowers, the monthly fees are between 1.5% to 4%; and lenders can enjoy an annual return of up to 25%.

up to R$50,000 for 6, 12, 18 or 24 months. For borrowers, the monthly fees are between 1.5% to 4%; and lenders can enjoy an annual return of up to 25%.

The co-founder, Paulo David, has publicly stated how difficult it is for small business owners to get loans for their companies. Therefore, his company’s mission statement is to operate in regions traditionally under-served by banks and the banking system. So far, the platform is doing really well and has already reached up to 2 millions Reais from loans.

3 Afluenta

The Afluenta startup was founded at September 2012. The platform is a bit different from others listed here, due to its need of having a bank account. Besides from that, to ask for your loan or to invest your money, Afluenta requests that you are older than 18, born in the operational countries and have both a mobile phone and an email.

was founded at September 2012. The platform is a bit different from others listed here, due to its need of having a bank account. Besides from that, to ask for your loan or to invest your money, Afluenta requests that you are older than 18, born in the operational countries and have both a mobile phone and an email.

They are the first authorized p2p marketplace at Argentina and they are planning to also operate around Latin America. They have recently started operating in Peru and the next countries should be Mexico, Colombia, Chile, Uruguay and Brazil. The minimal investment you can make at Afluenta is of $5,000 and the estimated annual return is 45.3%. As a borrower, your loan can be as high as $70,000 and your returning deadlines can be from 12 up to 48 months