About the Author: Marco Schwartz is an entrepreneur and p2p investor with many years experience both in the fiat and bitcoin p2p lending space. On his site smartbitcoininvestment he runs a successful blog, giving valuable insights on his podcast and posting his quarterly returns.

About the Author: Marco Schwartz is an entrepreneur and p2p investor with many years experience both in the fiat and bitcoin p2p lending space. On his site smartbitcoininvestment he runs a successful blog, giving valuable insights on his podcast and posting his quarterly returns.

I first heard about Peer-to-Peer lending back in 2012. At that time, like many people, I only knew about a limited amount of options to invest my money. Basically, either leaving the money at the bank, investing in the stock market, or buying real estate. However, I quickly understood that Peer-to-Peer lending is an amazing opportunity for an investor, and I started to learn more about it.

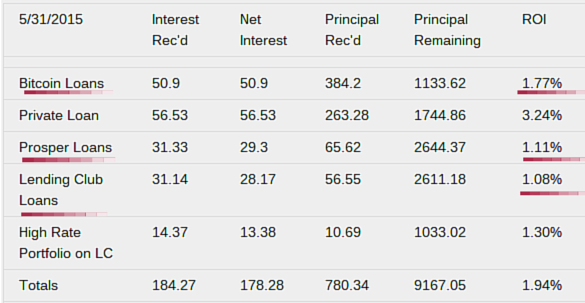

Since then, I invested on several Peer-to-Peer lending platform, and even in platforms that use Bitcoin as a currency (Follow the link to check out my quarterly returns on those platforms). In this article, I will share my experience with Peer-to-Peer lending platforms as an investor based in Europe.

When I wanted to start investing in Peer-to-Peer lending, I immediately encountered a major problem: most of the websites where I learned about P2P lending where talking about investing on the two major US platforms, Lending Club and Prosper.

That’s great, but these platforms are completely closed for European investors. The only option for an European investor would be to have an LLC in the United States, and invest via this company. And even with that option, the LLC itself should be accredited - so have more than $1 million of assets, or more than $200.000 of income per year. This was clearly not an option for me.

That’s when I started to look for platforms where I could invest in as a French resident. It took some time, as there were not so many platforms available at that time. There were some platforms in the UK, but there were only for UK residents.

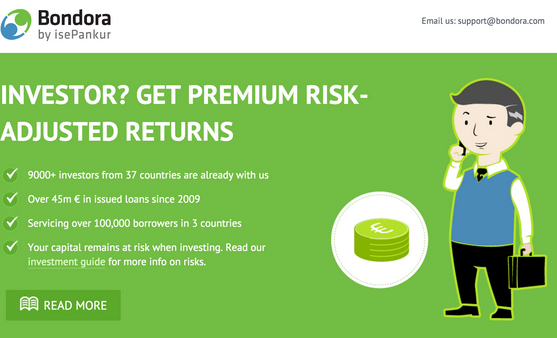

The first platform that I found was Bondora. Bondora enables p2p lending in Europe by providing a platform, which is based in Estonia. They offer loans only to people in the baltic countries, but any investor in Europe can invest on their platform. This is the page you will get when you go over to their website:

On Bondora, it’s really easy to open an account, and then to link a bank account. If you are based in Europe, you can pay via a SEPA bank transfer, and it usually takes less than a day to get my money from my bank to Bondora.

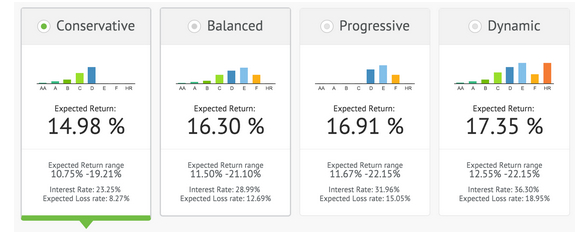

I started to test the platform and to invest manually in some loans. I started to like the platform, and put more money on it. However, I quickly found that the good loans (AA and A loans) on the platform were really quickly filled, so I turned towards the auto-invest features of Bondora which are really well done:

On this page, you can simply choose an investment profile, along with the expected return. It’s very easy to use, and in no time you can set a system that will invest on your behalf, every time a loan that matches your criteria will appear on the platform.

I’ve been investing on Bondora for more than one year now, with a current annual return of 17%. However, my default rate is currently really low, so I expect the return to drop over the next months due to some loans defaulting (the expected loss rate for the portfolio style I chose is around 8 %). This will still be incredibly high for p2p lending in Europe.

The other platform on which I invested in is Mintos. Mintos is a platform currently based in Latvia, but they plan to move their main office to London pretty soon. This is the welcome page of the Mintos website:>

The website itself is quite similar to Bondora and to other Peer-to-Peer lending websites: you can browse loans, invest, and they also offer an auto-invest feature. It’s also very easy to add money if you are based in Europe: you can use a simple SEPA transfer, and you’ll get your money in less than 2 days on average.

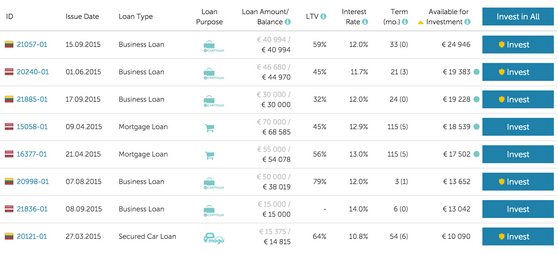

This is the screen from which you can browse & invest manually in loans:

You can also set some filters to select your loans:

One key difference between Mintos and Bondora is that each loan is attached to a collateral, for example a car or a flat, that the borrower needs to put on the table in case he/she doesn’t pay the loan back. Also, you will see that some loans comes with a little yellow shield just next to the invest button.

That’s another pretty cool feature of the platform: it means that for the best loans on the platform, a partner of Mintos is willing to buy back the loan in case it is more than 60 days overdue.

If I had to compare both, I would have to say I prefer Bondora for their auto-invest features, but I feel like my money is safer on the Mintos platform because of collateral. As always, I really recommend to diversify amongst many platforms, like you would do by investing in different stocks for example.

Even if Bondora and Mintos are my favorite platforms as an investor based in Europe, I am currently looking more and more to UK platforms. Indeed, some platforms like Assetz Capital or Saving Stream are starting to open up to European investors outside of the UK, so that’s a great opportunity to come as well.

This is definitely my next move as P2P lender in Europe, as it allows me to lend to more people but it also allows currency diversification with the British Pound.

In the future, I am really looking forward for many things. I think we will see more and more p2p lending in Europe, that enables any borrower or investor in the European Union to use these platforms.

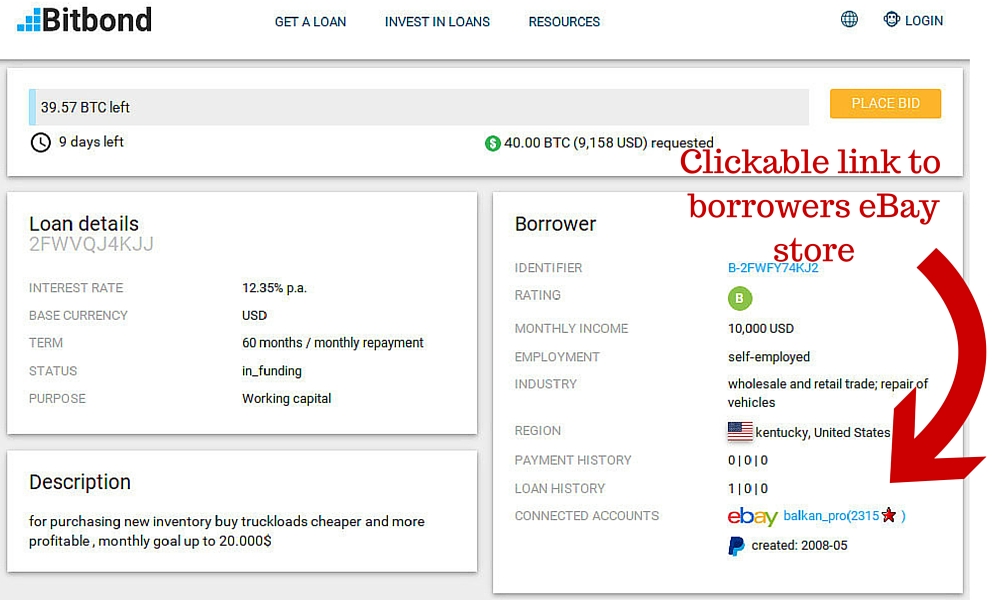

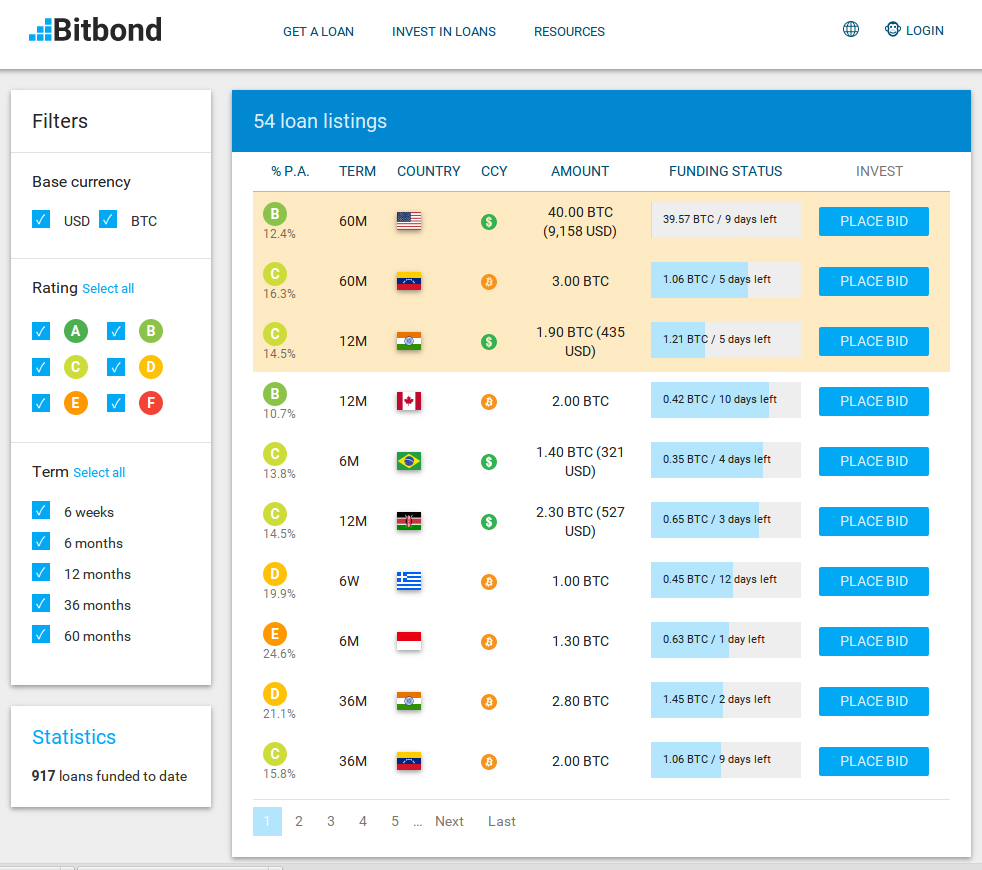

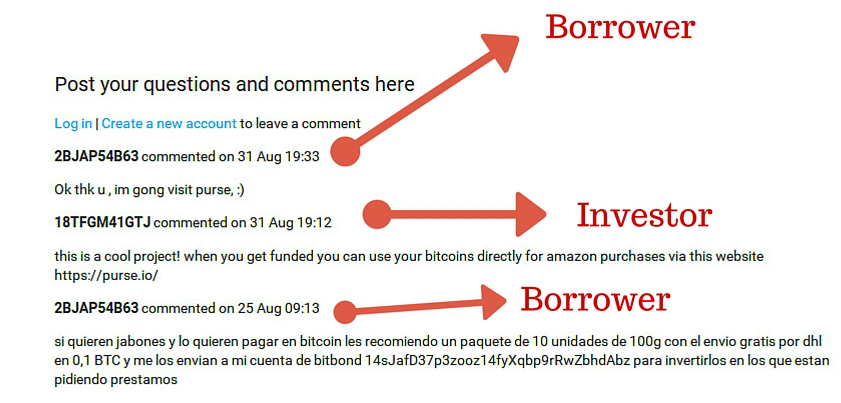

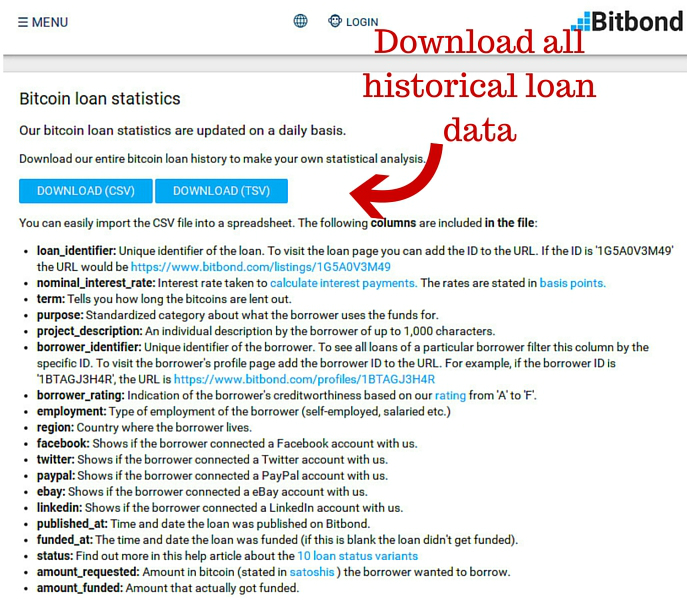

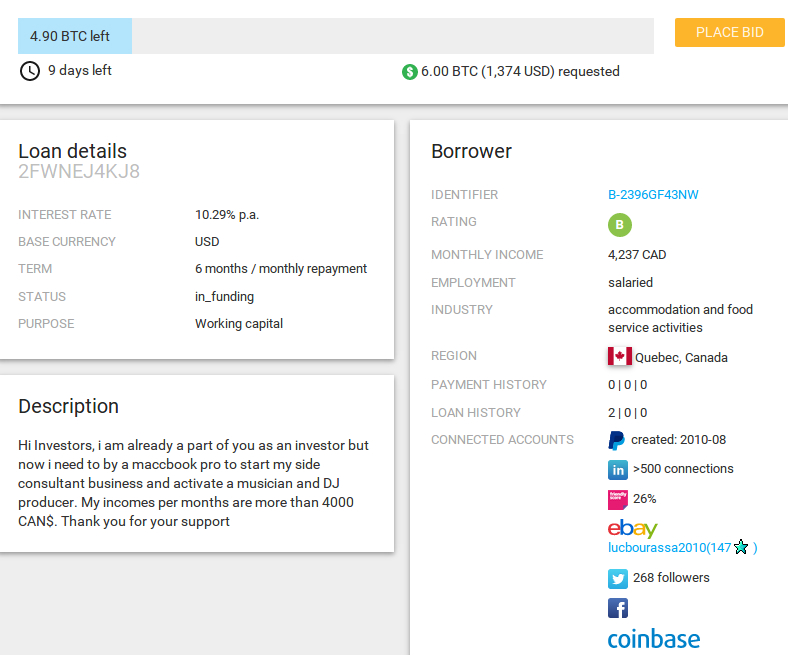

I think that at some point, US platforms will also open to European investors as well, as the regulations on crowdfunding & lending are getting more ‘loose’ in the US. Finally, I think Bitcoin is also an amazing opportunity for Peer-to-Peer lending, as it allows to instantly go above all the local regulations concerning Peer-to-Peer lending.

If you want to learn more about Bitcoin P2P lending, I invite you to check out my blog, Smart Bitcoin Investment.