- 7Shares

On November 17th, investors received the below email from Lending Club stating that the IPO shares of Lending Club (ticker: LC) are to be offered through Fidelity. Keep in mind it was recently reported that Lending Club may be seeking a buyer. If you are a Lending Club investor as of September 2014, you should have also received the email as well. This was a surprise since myself and many others speculated that the IPO would be offered through Loyal3. I outline the full process in this post and will continue to update this post as I hear more and hopefully successfully invest in the Lending Club IPO. If you’re wanting to get in on the IPO, I would recommend starting this process early. At the bottom of this post, you’ll also find other links to coverage of the LendingClub IPO.

Below is the email I received with the exception of some of the small print. It simply stated that in order to get access to the IPO, they had to share your information with Fidelity. Clicking the link confirmed that you agreed tt this and simply prompted you to login to your Lending Club account. The result was your Lending Club settings page and no confirmation was given. It would have been nice for some sort of ‘Success’ feedback. You have until noon (PT) on Sunday, November 23rd to complete this step.

Saturday, November 23

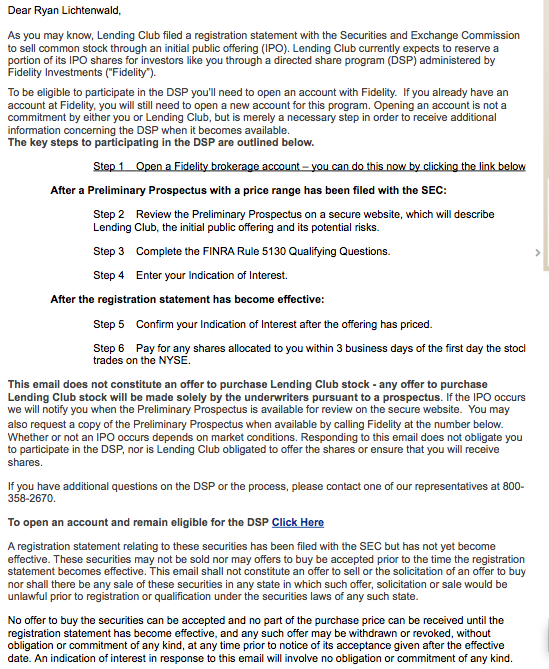

On Saturday, November 23rd people who had allowed LendingClub to share their information began receiving the below mail from Fidelity offering to open a DSP account. If you have received an email where the link doesn’t work, you should receive a corrected email which will work.

The result of clicking the link in the email outlines the process of opening an account. Keep in mind that even if you already have a Fidelity Brokerage Account, you still must open one specific to the LendingClub Directed Share Program. I had to provide the usual personal information including my employment information. It then asked questions about salary, net worth, liquid assets, risk tolerance and then finally asked to rate my investment experience. I also had to answer a few verification questions which are usually about a family member, previous car or address. Finally, it asks you to provide bank information to fund your account.

According to Fidelity, my account is under review and I will be contacted once this process is complete about next steps. It should take 1-2 business days at which point I’ll be able to fund my account.

Monday, December 1st

Peter over at LendAcademy wrote about LendingClub’s new S1 registration. Share price will be between $10-$12. At $12/share this is a valuation of $4.33 billion which is lower than some folks had anticipated. Retail investors like myself will have whatever is left after LendingClub employees, officers and directors get their chance to buy in.

Tuesday, December 2nd

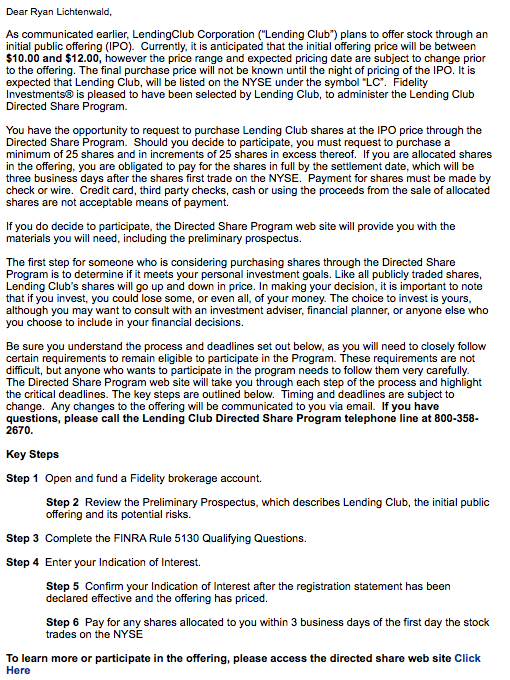

I just received the below email from Fidelity and you’ll definitely want to keep an eye out for this one as it walks you through the steps you’ll need to take to participate in the LendingClub IPO.

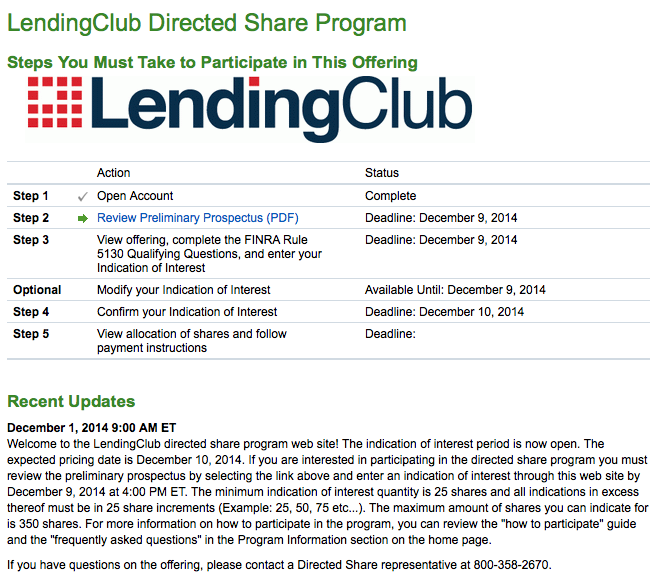

Make sure you click on the link on the last line above, it guides you to another website that lists the steps you’ll need to take in order to participate. It looks like this:

Note above that you can buy notes in increments of 25 for a maximum of 350 shares. This equates to a $4,200 investment if the stock is priced at the high end at $12/share. After you read through the Prospectus, you’ll be required to enter your indication of interest. I personally put in for the full 350 shares. You’ll have the ability to change this as noted in the deadlines above.

Monday, December 8th

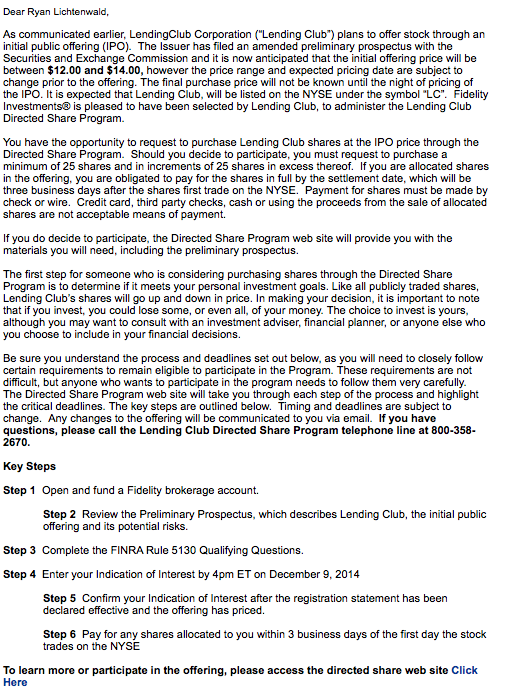

You should have received the below email if you have decided to participate in the LendingClub IPO. It highlights that LendingClub has filed an amended preliminary prospectus and the anticipated price will be between $12.00 and $14.00 a share as opposed to between $10.00 and $12.00 as previously quoted. Keep in mind you have until December 9th at 4pm ET to indicate your interest (up to 350 shares). Remember that this doesn’t guarantee you will be allocated that amount. It might be a good idea to fund your Fidelity account in case the shares are priced on the high end. This would apply if you have have expressed interest in 350 shares and get allocated 350. (350 * $14 = $4900) Keep in mind that the below email does state that you will be obligated to pay for shares in full by the settlement date, which is three business days after they first trade on the NYSE. Funding your account early will prevent you from having to rush a check or wire transfer.

Wednesday, December 10th

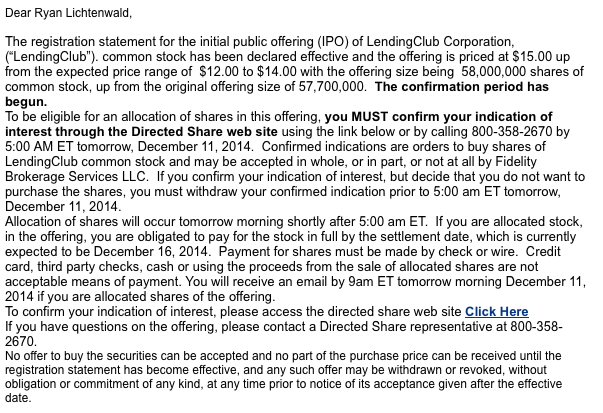

Today is the eve of the LendingClub IPO. The price has been set at $15/share - up from the previous estimate of $12-$14. I received the below email to confirm my interest and tomorrow morning I will find out how many shares I get allocated out of the 350 I requested. If you haven’t already confirmed your interest, I recommend you do so as soon as possible. Tomorrow should no doubt be an interesting day for this industry and I’m excited to be a part of it.

I will continue to update this post and welcome any discussion about the Lending Club IPO in the comments!

Here are a few resources you might find beneficial if you’re considering investing in the IPO. (Please note that none of this information should be considered financial advice)

Misc. Coverage

LendingClub Roadshow video with Renaud Laplanche

http://www.retailroadshow.com/sys/launch.asp?qv=18835697486065328&k=27322314862

Peter and I were both featured on this article from The Wall Street Journal:

Lending Club IPO: Finance Business Gets Tech-Stock Allure

Peter from LendAcademy’s IPO Coverage

Lending Club’s IPO Packs More than the Usual Legal Drama:

http://www.lendacademy.com/lending-club-ipo-legal-drama/

Lending Club Reserving Shares in their IPO for Retail Investors:

http://www.lendacademy.com/lending-club-ipo-retail-investors/

An Analysis of LendingClub’s Valuation:

http://www.lendacademy.com/analysis-lending-club-valuation/

Simon from LendingMemo’s Lending Club IPO Coverage

What making History Looks Like: Lending Club Files for IPO

http://www.lendingmemo.com/lending-club-files-500-million-ipo/

The Bear Case

Article from wealthfront outlining whether or not tech IPOs are a good investment:

https://blog.wealthfront.com/tech-ipos-good-investment/

- 7Shares

- 7Shares

I recommend this Wealthfront guide on what to think about when investing in tech IPOs: https://blog.wealthfront.com/tech-ipos-good-investment/

Thanks for sharing. I will add the link to the post. I plan to allocate a very small amount to the IPO. I assume you will not be participating?

Useful update re: the forthcoming email from Fidelity. Please keep us apprised of any news your hear, I’d love to know via twitter!

Thanks Ben, I will be sure to let you know of anything I hear!

Great article Ryan. I’ve decided to pick up a few shares just for the experience of it, but won’t be making it a serious investment. Your thoughts helped clarify the process for me, so thanks for that! Great post.

Why not a serious investment? Seems to me that it’s an easy win with a lot of potential upside. I intend to invest as much as I’m able.

Has anyone got word from fidelity? I followed the steps from the LC website few days ago…

Ap999,

I haven’t heard anything yet, but will definitely be posting anything I hear on social media and updating this post. If I had to guess, it won’t be until the deadline has passed on Sunday until we get another update.

I received an email today from fidelity! There are further instructions in there. Basically the email contained a link on how to open an account for th DSP for this IPO. It did say even if you are a current fidelity account that redoing this process is still a must to participate. I am sure everyone who in opted in should have received this email also. Once your account is open, they said we have to wait until the actual offering information is out.

The following is a copy/paste of what I recieved today.

As you may know, Lending Club filed a registration statement with the Securities and Exchange Commission to sell common stock through an initial public offering (IPO). Lending Club currently expects to reserve a portion of its IPO shares for investors like you through a directed share program (DSP) administered by Fidelity Investments (“Fidelity”).

To be eligible to participate in the DSP you’ll need to open an account with Fidelity. If you already have an account at Fidelity, you will still need to open a new account for this program. Opening an account is not a commitment by either you or Lending Club, but is merely a necessary step in order to receive additional information concerning the DSP when it becomes available.

The key steps to participating in the DSP are outlined below.

Step 1 Open a Fidelity brokerage account – you can do this now by clicking the link below.

After a Preliminary Prospectus with a price range has been filed with the SEC:

Step 2 Review the Preliminary Prospectus on a secure website, which will describe Lending Club, the initial public offering and its potential risks.

Step 3 Complete the FINRA Rule 5130 Qualifying Questions.

Step 4 Enter your Indication of Interest.

After the registration statement has become effective:

Step 5 Confirm your Indication of Interest after the offering has priced.

Step 6 Pay for any shares allocated to you within 3 business days of the first day the stock trades on the NYSE.

Like many others here, I have also received LC Fidelity email and have opened account and now wondering is it really wise decision to invest as valuations are little high here.

Any suggestion?

HS, did you check out the wealthfront article?

https://blog.wealthfront.com/tech-ipos-good-investment/

You might also find this beneficial from LendAcademy:

http://www.lendacademy.com/analysis-lending-club-valuation/

For me, I think we are in a unique situation to invest in the IPO and it might very well be the only IPO I ever invest in. I really believe in this industry, but with that being said - I won’t be investing very much. The amount I invest won’t make or break me. I may be naive, but in my opinion the potential for LendingClub is absolutely huge. They are still just a small fraction of lending overall and will no doubt move into different product offerings. Now whether or not it justifies a ~$5 billion valuation - I have no idea.

This and anything on this site should not be considered financial advice.

Hope those links help!

I hope so! I am also not a IPO type stock investor. This maybe the first and only one, and most people will never get a chance get shares pre ipo. So I setup my account, and I may invest a small amount and hope for the best. As for valuations, I am not so concerned I mean look at other companies that have been well over valued for years and years. Sure this may be a gamble. But it won’t effect me drastically, I’m calculating that I’ll invest no more than 3 to 5 percent of my investable assets.

I am not a current member of LC, but want to get in on the IPO.

I am also new to stocks. Is this only for current investors to get the pre-IPO price, or can I just buy this stock when markets open on the date of IPO?

Only investors in the LendingClub platform as of September get access to the IPO shares. You’ll be able to invest after they go public. Good luck!

They totally botched mine. I went through the opt in process and ended up not on Fidelity ‘s list. Trying to get LC and Fidelity to figure it out now…

Great info to keep us all informed. Im sacred that I might miss the NEXT email

Jose, I just received the next email - keep an eye out for it. I updated the post with screenshots.

I noticed the latest Fidelity emails says that payment must be made by check or wire. Im a little unclear on this.

If I fund my account I would think this would be sufficient to make payment. Ill have to look into this further.

Does anyone know the eligibility requirements for the DSP? salary, net worth, liquid assets, risk tolerance and rating of personal investment experience.

I don’t think you need to be accredited investor for this one. So you are good, as most people investing via DSP are not.

hs is correct. However, I did see an email that was sent to Fidelity customers about getting access to the LC IPO (this is separate to the email we received for being LC investors). That email did have some other requirements.

Update: Fidelity contacted LC and worked it out. I have been added to their list and just received the Fidelity email. Pretty fast. Supposedly they are sending out emails up until Dec. 1st. I was told afterward by LC if I had not received the Fidelity email by Dec. 1st, to contact LC. Just posting this for those that have not received their Fidelity email- It could just be that your account is further down the list and you will get it later, however, it could also be that even after opting in, you are not even on the Fidelity list at all. Worth it to give Fidelity a call just to check on it and make sure.

Good to hear they were able to get things figured out for you and thanks for sharing.

I wish we had some idea on how many we will have access to. I dont want to take out investments and place them on hold if they will not be used.

Jose, I agree. I can definitely understand if you’re planning to sell some other investments to get in on the IPO. Perhaps anything leftover could just be put into LendingClub notes 🙂

I signed up on Fidelity and funded my account. Has anyone received anything after the 1st step ?

Nope, not yet. I’ll be sure to update this as soon as I hear anything.

As LendingClub prepares to take the company public, we at EquityZen have been thinking about the company’s remarkable growth — and how it’s become the largest P2P lending platform in the world. We created a helpful infographic that tracks LendingClub\’s growth and decomposes the capitalization table: https://equityzen.com/blog/lending-club-path-to-ipo/

Please let us know if you have any thoughts.

Thanks for sharing this!

Thanks for posting this - I’m curious the number of shares you were allocated. I requested 200 lending club shares and got 150. Glad I could get in on it but was wishing at asked for an allocation 350!

Hi David, no problem. I had requested 350 and received 250. I’ll be posting tomorrow what I ended up doing with my shares - what a crazy day!

It looks like the stocks for lending club have got super high, but eventually everything crashes in the financial market so after reading this article: http://sentienttechnologies.com/lending-clubs-party-stock-will-collapse-another-software-entrepreneur-know/ - i think it’s only a matter of time before that happens with this company as well.

Edmund,

Interesting thoughts, but I’m personally not convinced. There certainly will be ups and downs, but I think p2p lending has a bright future. Time will be the true test.