The world of Marketplace lending seems to have fallen into complete disarray in recent times. Prosper had to lay off 28% of its workforce earlier this month, Lending Club’s CEO resigned, and OnDeck’s performance left many analysts disappointed.

It’s fair to say, that May has been a month to forget for US’ peer-to-peer lending platforms. Across the pond however, European platforms are providing a huge amount of fun for those of us who have taken the plunge with a peer to peer investment.

Today, I want to talk about the three European platforms I have been enjoying the most: Bondora, Bitbond and Mintos. Let’s get cracking!

(ALL images are Media Files. Simply click on them to magnify :))

Bondora | The King of Eastern Europe

My peer to peer investment experience on Bondora has been joyous. Founded in 2009 by the exciting young entrepreneur Pärtal Tomberg, Bondora is quickly establishing itself as a major player in the European Market. The platform boasts a net annualized return on investment of 17.56%, and over €63 million in loan originations. Although 17.56% seems a little high from where I am standing, the excellent Claus Lehmann has seen returns around the 17% mark.

So how do they do it? Well, Bondora seems to have nailed a specific niche: (mainly) Eastern Europe. Only borrowers located in Slovakia, Iceland, Finland - and the notable exception - Spain, can apply for a loan. Restricting their pool of borrowers, seems to have provided them with a great expertise on filtering out the great from the bad. (In fact, only two countries are represented in my portfolio: Estonia and Finland!)

As a result lenders located in the SEPA region can make their peer to peer investment, safe in the knowledge that they will make a return.

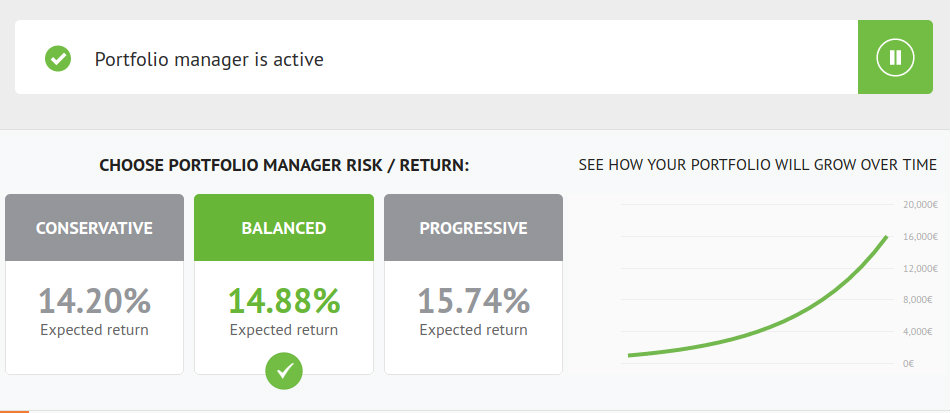

Initially, it seems that lenders couldn’t have it any easier on the platform. You simply add funds your Bondora account, set a desired bid size, choose your risk profile and activate your portfolio manager. As you can see from my Screenshot, I have opted for the “Balanced” approach which gives me an expected return of 14.88%. The funds will then automatically disburse into loans which fit your risk profile. Easy.

(By my calculations, I have received slightly higher returns than that. But I will not be sending a letter of complaint ;))

What more is there to know? Although the process of placing a peer to peer investment seems straight forward on the surface, it turns out to be quite a convoluted process if you care to dig deeper. As Lehmann puts it:

Importantly, this only applies if you do not activate your portfolio manager.

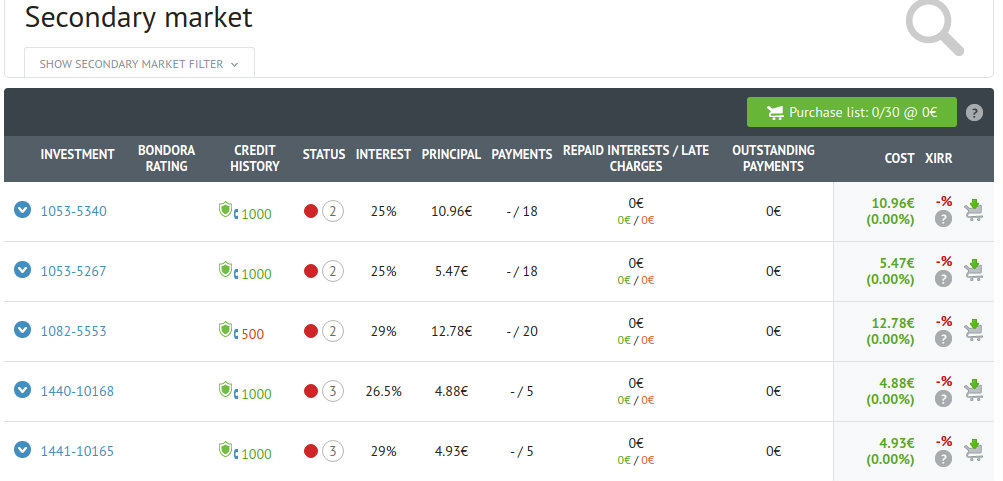

Another important feature for peer to peer investors, is the thriving secondary market Bondora offers.

Here, you can make a particularly cheap peer to peer investment. Subsequently, though the repayment rates are lower and the corresponding risk of default is higher.

Overall, Bondora is going from strength to strength and is providing a huge amount of fun to p2p lenders like me. Long may it continue.

Bitbond | The Future of P2P Lending

I first came across bitcoin peer to peer investing over Stu Lustmann’s excellent p2p lending blog. Specifically, it was his earning report for May which peeked my interest.

Fascinated, I started researching the bitcoin lending space, and decided to invest in Bitbond. By documenting my experiences along the way, I have tried to spark other traditional p2p lenders into giving it a shot.

But before we go into my experience on the platform, let’s take a step back to understand what Bitbond is really about and why I think it’s fascinating.

Founded in Berlin, 2013 by Radoslav Albrecht, the fintech startup has received ~€1 million in VC funding and has been growing at a significant pace for the last year or so. Now counting +30,000 users, the bitcoin lending platform specialises in providing small business loans to borrowers around the world. The international aspect of Bitbond is exciting, and is the reason why bitcoin is used.

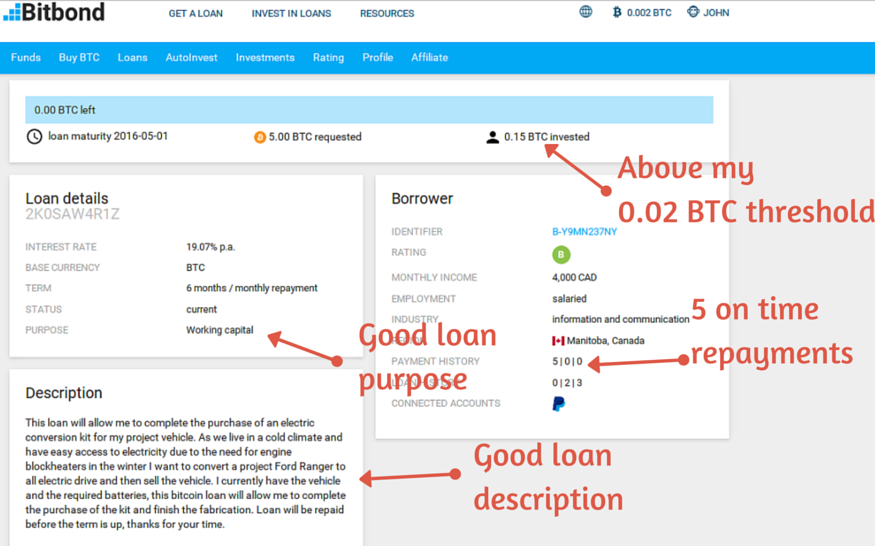

By cutting the banks out of the process, lenders can place a peer to peer investment and borrowers can take out a loan regardless of location. The thought of supporting small business owners globally seemed pretty cool to me, so I started investing.

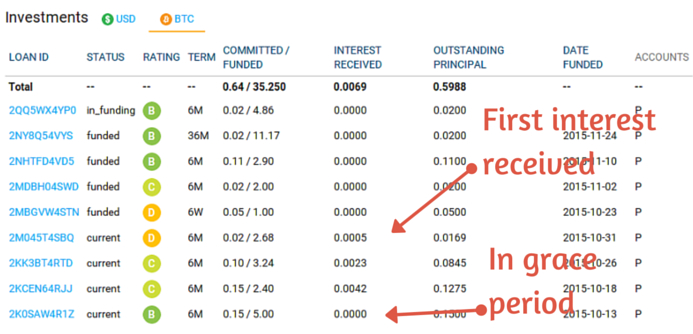

As I suspected, the more personal experience Bitbond offers has proven itself to be massively enjoyable. Currently, I am supporting an eBay powerseller from Portugal, an Indonesian Taxi Driver, and an Entrepreneur located in the Philippines.

On the flipside, the risk investors take on is substantially higher than on the other platforms mentioned here. Borrowers are often still becoming acquainted with bitcoin technology, which can also delay repayments by a couple of days.

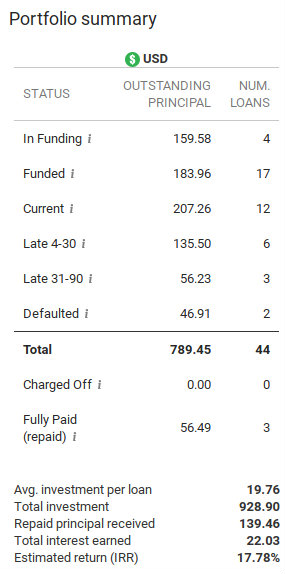

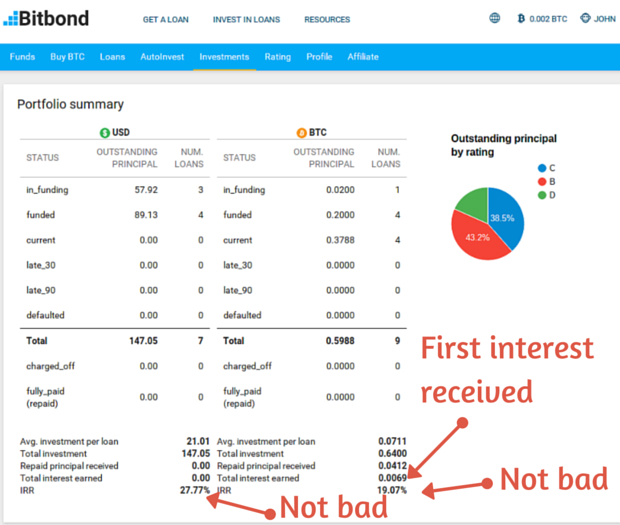

Fundamentally though, my portfolio is looking pretty good.

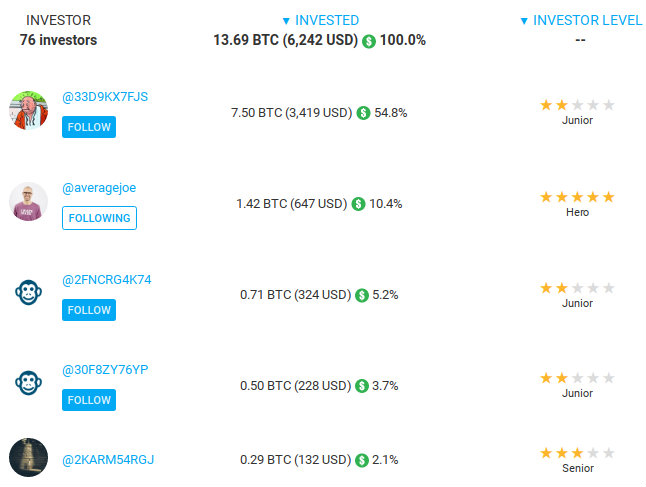

Another important point, is Bitbond’s transparency. All investors are listed on the loan pages (with pseudonyms), and can communicate with the borrowers directly via the comments sections!

Overall, the investing process on Bitbond is more personal but less efficient than on Bondora.

You can however activate the AutoInvest feature, to automate your peer to peer investments, but I have chosen against this to maintain the human aspect of the platform.

Finally, you might be saying: “I don’t have bitcoin and don’t know how to get some, so peer to peer bitcoin lending isn’t for me.” Well, you’re entitled to your opinion, but buying bitcoin on Bitbond is as easy as transferring funds on Bondora. As long as you are in the SEPA region, you will be able to buy bitcoins directly on Bitbond.

For those of you located outside of the EU, use Circle or Coinbase to get your bitcoins at zero exchange costs.

I think bitcoin peer to peer investments will be massive in the future!

Mintos | The Rising Star of European P2P Lending

Significantly younger than both Bondora and Bitbond, Mintos, the Latvian p2p loan marketplace, was founded in 2015. Intriguingly, Mintos harbours some significant differences to other peer to peer investment platforms, because it brings together investors and loan originators! These include Mogo, Capitalia and Debifo among others. From an investors perspective, this makes the process a tad more anonymous but that’s not a KO-criteria for me.

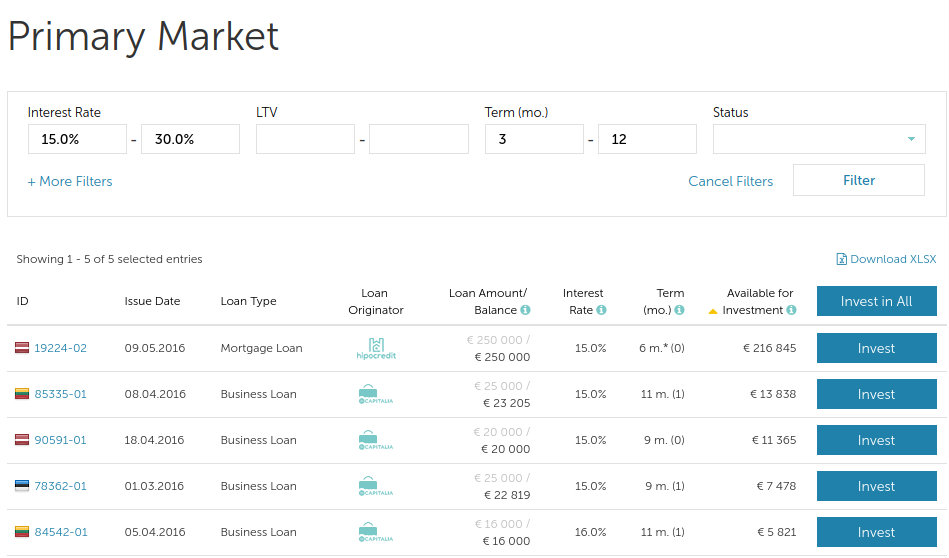

Mintos is probably the least well known platform of all three discussed here. It’s relative obscurity belies its massive size however, with over 4000 loans listed in the primary market and a staggering +11,000 in the Secondary Market. With so many options, what can lenders expect from their peer to peer investment here?

(There are only five listed here because of the filters I have set)

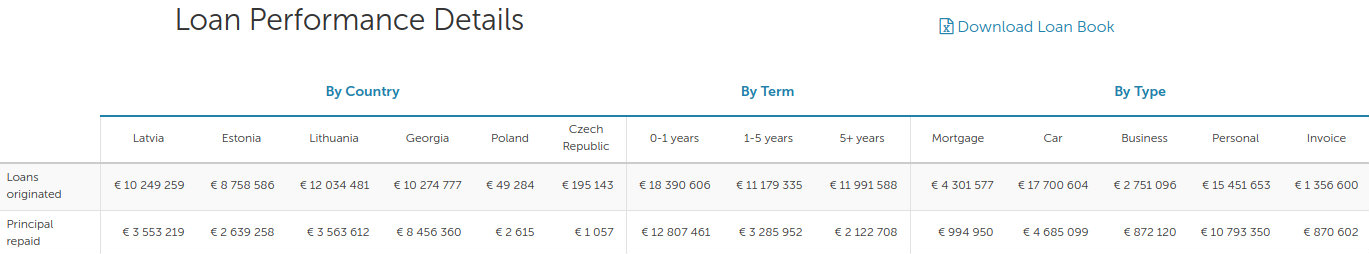

Like Bondora, Mintos specialises in bringing European investors together with Eastern European borrowers. Below you can see their loan originations by country to get a better feel for the platform.

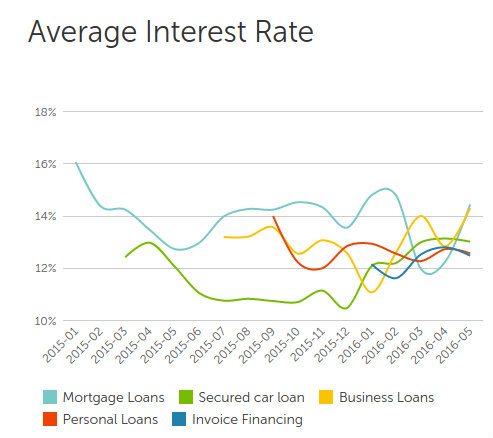

As per the industry standard, the interest rates for borrowers, depend on the quality as well as the purpose of their application. As you can see from the Screenshot below, in May of this year, “Invoice Financing” at 12.48% and a “Mortgage Loan” at 14.44% represent the low and high end of the spectrum in terms of interest rates.

What sets Mintos apart, is the very high level of security offered to Investors. Indeed, most loans on the plattform are either secured - ie. the borrower provides collateral - or come with a buyback option if the borrower is +60 days late on his payments.

As a consequence, the interest rates are lower than on the other platforms, and so is the potential payout to investors. Surprisingly Mintos does not (to the best of my knowledge) provide statistics with regards to the average ROI, but my personal experience has been ~9% pa.

Like this investor however, I think that Mintos could do with increasing the number of short term business loans available on the platform.

Overall though, Mintos is an excellent platform which I will continue to enjoy for some time to come!

Peer to Peer Investment | My Experience

With that under out belt, I hope I could shed some light on a few of the lesser known peer to peer investment platforms in Europe. As a takeaway, I would consider the following categorisation appropriate:

Bondora -> Small/Medium Risk -> Attractive ROI

Bitbond -> Medium/High Risk -> Very Attractive ROI and enjoyable personal touch

Mintos -> None/Small Risk -> Less Attractive ROI (but still ~10%)

Happy hunting 😉