With ROIs topping 12% per annum, it’s tough to beat Mintos right now, which is why this review is a necessary addition to the Peer Social Lending blog. Before we get into the nitty gritty of this Mintos review however, let’s tackle the basics.

Founded in 2015, the eastern European peer-to-peer lending platform has originated close to €40 million and counts +8,000 investors among its ranks. Average net annual return is +12% although myself and Wiseclerk are both making slightly more than that. And so will the equity investors who have funded the Riga-based fintech startup to the tune of $2.2million in venture capital.

As is the case with most peer to peer lending sites, the story of Mintos really begins with the credit crisis of 2008-09, when asset values of eastern European banks slumped by two-thirds. As a result, the banks shut their doors and loans became extremely hard to come by. This left the eastern European market wide open, allowing platforms like Mintos and Bondora to fill the gap left by the banks.

Key to understanding their success is the SEPA region which allows investors from around Europe to fund eastern European borrowers. Because of the Euro, lenders from any of the 35 member states can invest and make high returns. Unsurprisingly, in the face of 0.5%-1.5% interest offered by the banks, many German, French, and Swiss investors are grabbing the high-yield bull by the horns and flocking to the gates of Mintos.

As a result, Mintos.com receives around 210,000 visits a month from yield-hungry, yet safety-conscious investors, spurring on its already encouraging growth. And so far, this story is missing one key component: some loans on the platform are secured by the borrower’s real estate. This aspect has been key to allaying investors fears, who traditionally pursue more conservative investment opportunities, having had their fingers burnt on the stock market since the turn of the century. Be sure to check which loans are backed by real estate as it is stated on those particular loans.

With that under our belt, let’s take a look at the platform feature-by-feature in order to get a good idea of its quality and attractiveness for private investors like you and me.

Let’s get this Mintos Review started with the Loan listings

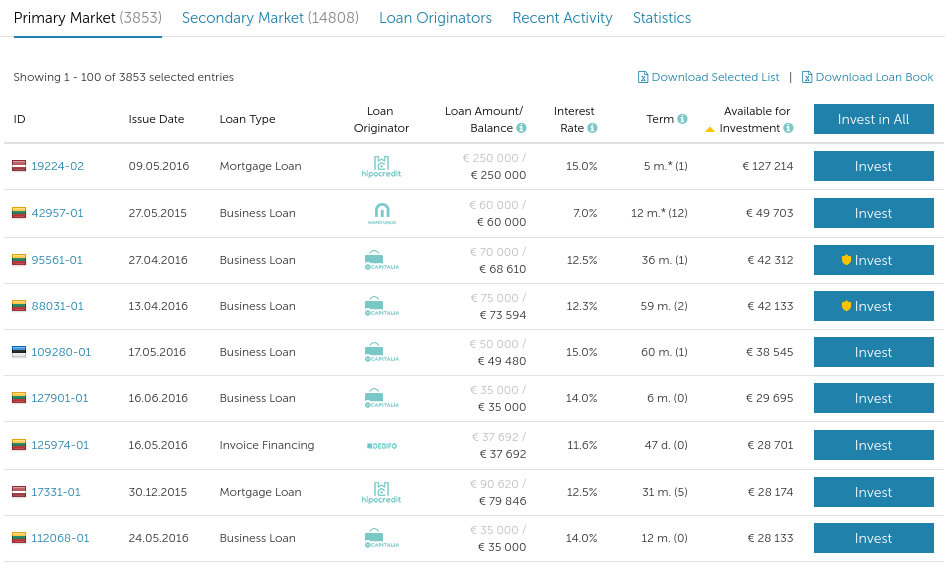

The loan listings represent the beating heart of any peer-to-peer platform. In Mintos’ case, that heart is beating to the tune of 3854 investment-ready loans listed in the Primary Market. For diversification-addicted lenders like me, this is the ideal scenario. Literally thousands of borrowers ensure that any lender can spread risk and protect his/her portfolio effectively.

You still carry the risk of regional economic turmoil, as all borrowers are either from Latvia, Poland, Lithuania, Estonia or the Czech Republic, but most loans are secured with real estate, so even if eastern Europe should face economic apocalypse, investors money is (relatively) secure.

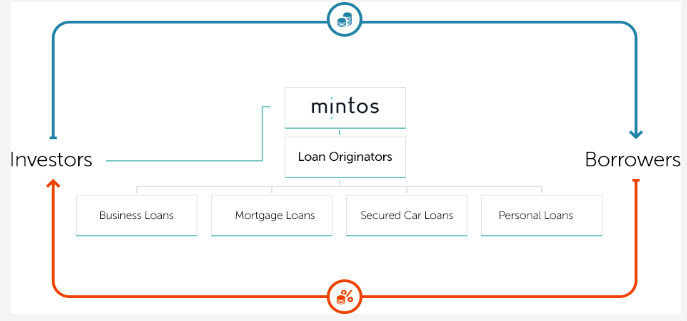

Additionally, all loans on the platform are provided not by Mintos itself, but by third party loan originators. As a result, certain loan originators can offer a buy-back guarantee, which means that if the loan is delayed for 60 days, the loan originator repurchases the investment for the nominal value of the principal and the accrued till the date of repurchase.

Let’s take a look at the key metrics for investors:

- Loan terms between 1 to 120 months

- Loan amounts vary between €100 and €250,000

- Interest rates typically range between 7% to 14%pa.

- Monthly repayments

- 0% fees for investors on the primary market. 1% fee on any sale on the secondary market.

- Minimum investment is €10

- AutoInvest Tool is availabe

- Open to anyone located in the SEPA region

- ~12% average ROI (according to website)

This is what the primary market looks like:

The shield visible in some of the “invest” buttons signifies those loans which come with a buy-back guarantee from the loan originator. These are my favourites, providing an excellent risk-to-return ratio, and giving my stressball some much needed alone time.

That being said, my conservative investment strategy coupled with relative newness on the platform, has resulted in this option not having been exercised yet. Wiseclerk on the other hand, who has been investing longer and more seriously, shares:

“Over 70% of my investment is in loans secured by buyback guarantees. So I don’t have to worry much about individual defaults risks of these loans but rather about the operator risk: will the loan provider be able to honor the guarantee? So far it works seamlessly. All covered loans that have gone 60+ days overdue have been reimbursed to me as promised.”

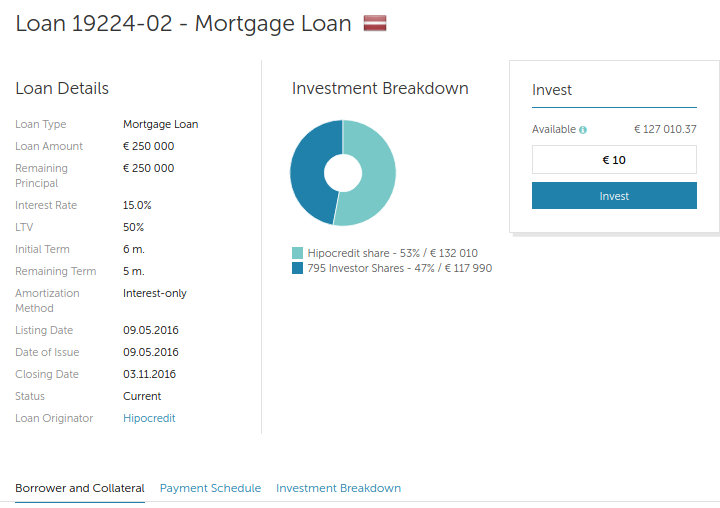

So what does an individual loan listing actually look like? Like this:

As you can see from the screenshot, the borrower, collateral, payment schedule and investment breakdown are readily available at the bottom of the page.

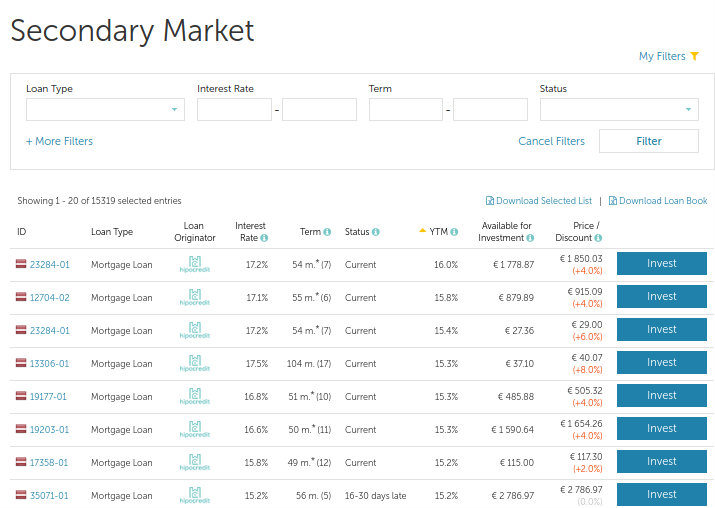

How good is the Mintos’ Secondary Market?

The secondary market forms the backbone of Mintos’ business model so I expected it to come at me all guns blazing. I was not disappointed. Very liquid, easy to use and relatively cheap, the secondary market is one of the best in the business.

Whenever a loan on my books approaches the 30 days overdue mark, I list it. After swallowing the 1% fee and offering a discount of around 3% to 4%, I still receive the outstanding principal plus interest back, which is substantially better than a default.

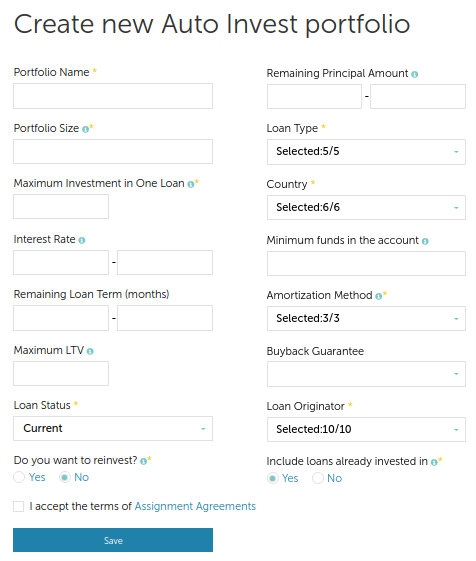

What about Mintos’ Auto Invest feature?

As the name suggests, Auto Invest automatically implements your preferred investment strategy across the available loan listings. The criteria you are allowed to specify are (click on the image to see its full size):

Interestingly Auto Invest does not invest in loans from the secondary market. This feature may well be added later, as many lenders with a bigger risk-appetite than me, look to scoop up discounted gems.

User experience on Mintos

With the core features out of the way, it is time to dedicate a little bit of space to the excellent usability of the platform. From the outset, Mintos is pleasing to the eye, and boasts a slick interface with unobtrusive load-times.

Once signed-in, the platform is easy to navigate and the F&Qs present answers to most of the questions users may have. On top of that, customer support responds to questions within a day or two, and visitors can leave questions and feedback from the homepage.

All-in-all, the platform is a real joy to invest on.

Mintos Review | Conclusion

Mintos’ is an attractive proposition for lenders located in the SEPA area. The average net annual return is higher than on most competing platforms, and the usability is excellent. The liquidity of the secondary market is encouraging, and the repayment rates are reassuringly high.

The Auto Invest feature works well, and the impressive number of loan listings allows investors to diversify to their hearts content.