Twino Review - Mentioning Twino to most European investors induces little more than a shrug of the shoulders and a muffled “never heard of them”. Not an unsurprising response, given the platform only launched in 2015, and has kept a relatively low profile compared to competitors like Bondora, Mintos and Bitbond.

A strong gut feeling suggests however, that Twino will soon emerge from the backwaters of European p2p lending, and take its place among the market leaders. Why do I think so? Let’s take a look!

Twino Review | Covering the Basics

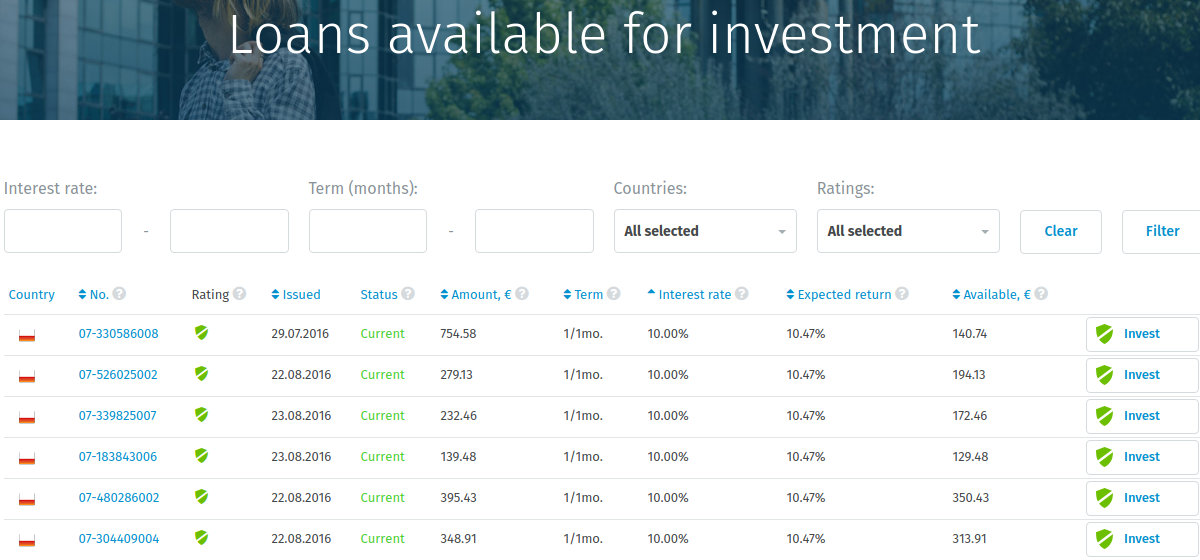

Launched by the Finabay Group in 2015, Twino offers investors from across Europe the chance to earn healthy returns by investing in unsecured p2p loans. These are consumer loans from Poland, Georgia, Latvia, Czech Republic, Russia and Denmark, commanding interest rates between 10-40% per annum. Loan terms vary between 1-24 months, giving investors more flexibility in the short term, but potentially lower returns in the long term.

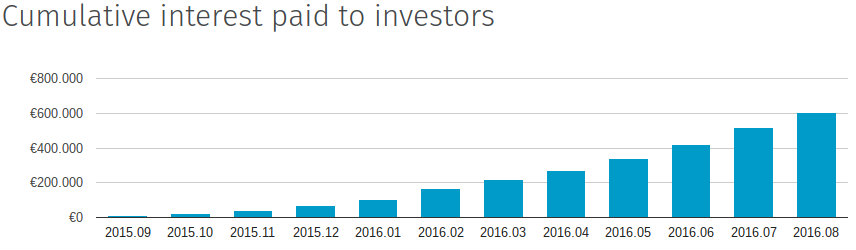

Returns seem to be healthy however, and investors have reportedly earned €600,000 in interest. Not bad in 11 months.

One of the reasons Twino’s growth has been so rapid, is its accessibility to investors from the Euro-zone AND Great Britain due to a partnership with Swedbank. As a result, investments can be made in euro (EUR) or British Pound (GBP), with the minimum being €/£10 .

This was doubtlessly a shrewd move by CEO (and former Bondora CMO) Jevgenijs Kazanins, because it opens the platform up to the more mature British Peer-to-peer lending market.

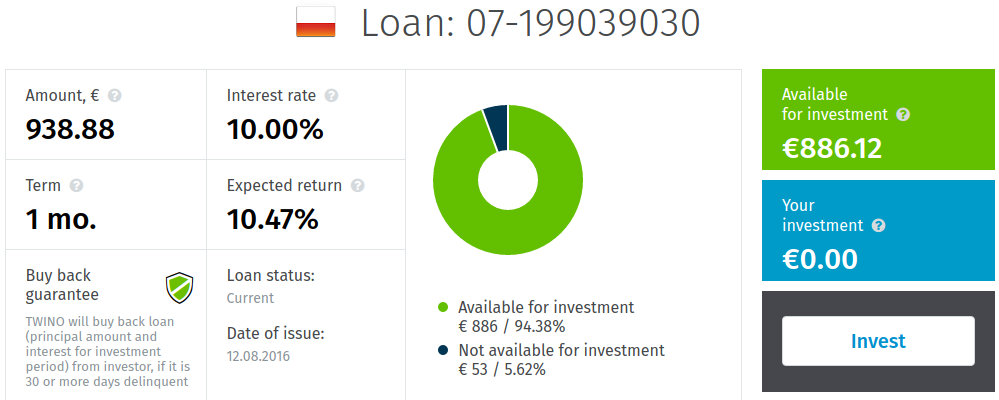

Another reason the Latvian marketplace lender is doing so well, is its highly popular “BuyBack Guarantee”, which promises to repay the investor principal plus interest, if a borrower is 30 days overdue on a payment. Most loans on Twino come with this guarantee and are sign-posted with ( ).

).

(Click)

This feature is proving particularly attractive to German investors who are typically risk-averse and make up a majority of the platforms’ investors.

But how can Twino sustain a BuyBack guarantee like this? Especially in the face of zero fees for investors?

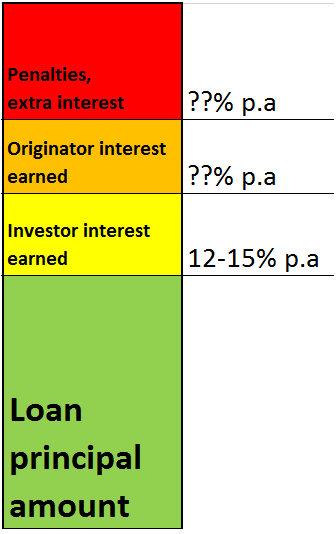

Well, the answer is Twino’s business model, which relies on a large gap between the returns that investors make, and the interest rates borrowers pay. As highlighted by the excellent Money is Your Friend, most loans on Twino are payday loans with likely interest rates of 100% or higher.

Well, the answer is Twino’s business model, which relies on a large gap between the returns that investors make, and the interest rates borrowers pay. As highlighted by the excellent Money is Your Friend, most loans on Twino are payday loans with likely interest rates of 100% or higher.

Interest rates offered to investors, as already mentioned, only range from 10-40%. The resulting margin is what Twino relies on to keep the BuyBack Guarantee viable and the business afloat.

For investors, this means BuyBack is unlikely to disappear anytime soon, as Twino’s business model depends on it. Additionally, the marketplace lender needs the feature to onboard new investors. With over 15% of all loans “delayed”, the platform would otherwise have a hard time turning a profit for its users.

The feature doubtlessly offers investors a greater level of security, but still depends on the profitability of the originators, which back the loans.

Twino’s Auto Invest Feature

You can easily automate your investments along strict parameters with Twino’s Auto Invest feature. A particularly welcome part of the investing experience, as it allows to easily diversify funds across a large number of loans, spreading risk in the process.

Luckily, Auto Invest is very easy to use and key parameters are:

- Total investment

- Maximum investment per single loan

- Minimum balance

- Reinvesting

- Interest rates

- Loan terms

- Countries

The huge number of loans on the platform, ensure that no matter which parameters you pick, the Auto Invest tool will be able to diversify aptly.

Once you have automated your investments, head over to the “My Investments” tab to see it in action.

Although the feature usually does its job well, be sure to log back into your account after a few days to ensure it is working correctly. 😉

Benefits for Investors

Twino simply offers a great experience for investors. The security of the BuyBack Guarantee, coupled with an easy to use AutoInvest feature, and slick interface combine to create a winning experience for anyone looking for easy passive income.

There are hundreds of loan listings to choose from and the low, €10 minimum investment, ensures that everyone can start investing.

Uk investors will also be delighted at the prospect of finding an eastern European marketplace, which allows lending in British Pound. This is sure to give Twino the edge over similar competitors lacking in this department.

With returns averaging around 12% p.a. for most, and almost 15% for some, Twino is proving its worth to investors around Europe.

Negatives for Investors

There are only two aspects of Twino I’m not 100% on board with. The first, is the nature of the loans, and the exorbitant interest rates charged to borrowers. I prefer to invest in working capital loans, with reasonable (max 40% p.a.) interest rates for borrowers. On Twino, we are dealing with Payday loans with interest rates going much higher than that.

The second aspect is the lack of personability on the site. Twino might as well be a bank, rather than a Peer-to-peer marketplace, because investors get little-to-no information about the borrower.

I understand that this is not a problem for most investors, but my personal preference is to feel like I’m helping people, not just making a profit.

Those are my only two bug-bears and they do little to diminish the enjoyment of the platform.

Conclusion | Twino Review

Twino is clearly a platform on the rise. The 30 days BuyBack Guarantee along with the sleek Auto Invest feature, provide a high level of security which is hugely appreciated by investors.

The impersonal style of the listings however, takes some of the humanity out of the platform and makes p2p investing a little less fun than on other platforms.

Thanks for reading.

PS. Have you tried out Twino? Let me know what you think of the Twino review in the comments below!