Peer to peer lending platforms in Europe have experienced staggering growth in the recent years. In this article you will find our review of the most popular European peer-to-peer lending and investing platforms. Many of these lending platforms are smaller compared to the big three in the UK (Ratesetter, Zopa and Funding Circle) but they keep geeting bigger, and one of the leading platforms in Europe - Mintos - has funded more than €4 billion in peer to peer loans.

The peer to peer industry changes every day, and the list will continue to be updated with new platforms!

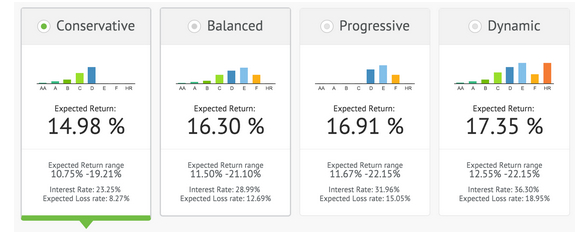

Bondora

Bondora is also one of the more popular lending platforms. Over 88,872 people have invested over €311M and earned €35M. Start with a minumum of €1, and become finacially independant!

Use thier Go&Grow account to earn 6,75%* per annum. It is easier than ever - just add funds to your account and earn daily interest! The best thing about the Go&Grow account is that you can liquidate your with ease by just withdrawing your funds at any moment!

Bulkestate

BULKESTATE - it is the first platform of group real-estate investments and purchases in Latvia. Despite the fact that the head office is located in the capital of Latvia — Riga, the company works with real-estate objects in all three Baltic states. Bulkestate offers to earn with them, by investing funds in real-estate projects with annual return on investment of up to 15% and profit withdrawal period from 3 to 24 months. Additionally, the minimum investment amount is only 50 euros.

Crowdestor

Crowdestor is one of the most popular peer to peer lending platforms in Europe. Within two years the platform has managed to fund more that €18M in business loans, earning up to 21% for the investors!

The company offers many projects on a weekly basis, and you will always have a new project to invest in! For more information visit their website: www.crowdestor.com

Debitum Network

Debitum Network is a P2B platform which allows anyone to invest in business loans from as little as €50 and earn interest from 9 to 11 %. All investments carry an additional guarantee for all investments. Loans are assessed by independent 3rd party risk assessors. There are 0% fees on the platform for investors. All investments are accepted instantaneously. Debitum Network allows depositing of EUR and GBP, as well as cryptocurrencies of ETH and DEB tokens.

EstateGuru

EstateGuru is one of the leading a peer-to-peer lending platforms for property loans, where users can borrow and lend money to fund real estate projects. As of 2016 EstateGuru has funded more than €106M in real estate loans, the platform has 35,447 investors from 106 countries, with an average return for investors of 11,94%. All loans are secured with mortgages.

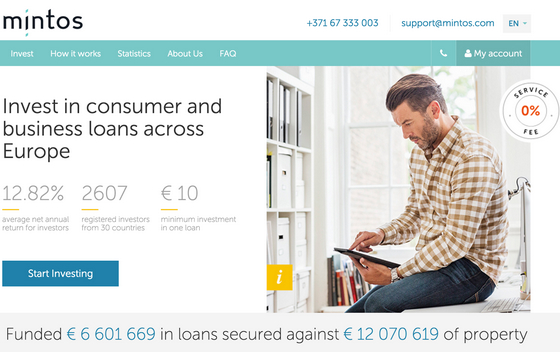

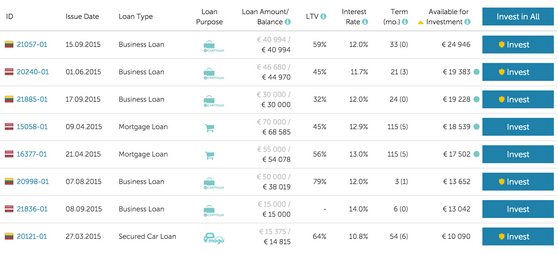

Mintos

Mintos is one of the most popular peer to peer lending platforms operating in Europe. They provide retail investors with an easy and transparent way to invest in loans originated by a variety of alternative lending companies around the world.

PeerBerry

PeerBerry is a peer-to-peer marketplace offering an opportunity to invest in issued non-banking lenders loans from across Europe. The portfolio of loans on offer primarily consists of consumer loans originated by Aventus Group and its subsidiary companies.

Viainvest

VIAINVEST is a peer-to-peer lending platform offering private lenders/individuals and legal entities an opportunity to invest into short-term consumer loans originated across Europe. VIAINVEST provides investors an access to non-bank lending sector by creating a safe and transparent investment environment where investors are able to earn up to 12.2% p.a. on their capital. To maximize the investing experience VIAINVEST has developed several important features, such as a Buyback Guarantee and auto-invest option to make the investment process reliable, simple and seamless.

If you want to read more about the world’s best peer to peer lending platforms, read our previous article: “Peer to Peer Lending Sites → 24 of the World’s Best”

About the Author: Marco Schwartz is an entrepreneur and p2p investor with many years experience both in the fiat and bitcoin p2p lending space. On his site

About the Author: Marco Schwartz is an entrepreneur and p2p investor with many years experience both in the fiat and bitcoin p2p lending space. On his site