- 7Shares

This is a guest post from Rob Misheloff from SmarterFinanceUSA. Rob specializes in helping small businesses get access to loans - some of which he refers to peer to peer small business loan sites. I invited Rob to do a post since small business lending is something I don’t know much about. As you may know, there are many peer to peer lending companies involved in this space - Dealstruck, Lending Club and OnDeck to name a few. I look forward to learning more about the companies involved in this space, but for now here is a brief introduction and infographic to peer to peer lending for small business.

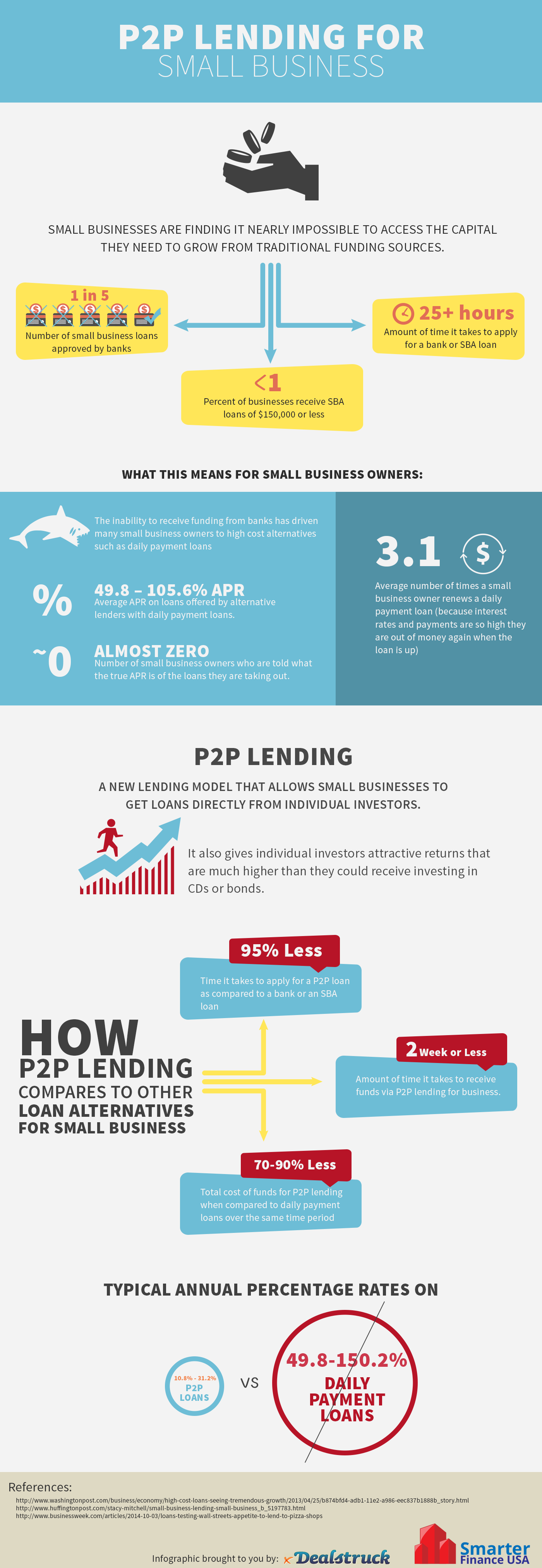

P2P Small Business Lending Vs. Other Models

One segment of the lending universe that is seeing growth in the P2P space is the small business lending world. Small businesses have been in a bit of a bind in terms of borrowing over the last decade. This “bind” for small business owners comes from the fact that bank loans can take two or more months to get, require hours and hours of paperwork, and have dismal approval rates (20%, but many believe that number is overstated as it doesn’t account for the percentage of business borrowers who are told not to apply by a bank loan officer).

The alternatives most often offered to small business owners are short term loans of 12 months or less that take the form of “daily payments” offering interest rates ranging from 50-150%.

Many small business owners believe those two extremes represent their only options, but some P2P (or P2B, if you prefer) lending models have emerged, covering the “gap” between unobtainable traditional financing and usurious daily payment loans that put small business owners in the position of using all their profits to pay back egregious finance charges on high interest loans.

While peer-financed loans can be a good option for many small businesses, many don’t take advantage of it due to the lack of awareness that the option exists. Several models have emerged that offer small businesses rates that are slightly higher than bank lending, but often less than 1/3 of the rates of the daily payment loans many small businesses believe are their only option.

The following infographic by Smarter Finance USA highlights the differences between daily payment loans and P2P small business loans currently available.

- 7Shares

- 7Shares

Great infographic. Definitely going in my Must Read P2P News next Tuesday. Have been surprised that more online opportunities for small business loans have not come around but still expecting a pickup in 2015.

Any insight into the success of the small business loan experiment at Lending Club?

Nope, I really haven’t heard much about it and like you mention - I think we will see more entrants and traction in this space. Hopefully they will get more coverage too as I think it’s a great option for small businesses. It’s all about educating business owners on the fact that they don’t have to go to a bank anymore.