There has been quite the discussion brewing over on the Lend Academy Forum about a recent change from Lending Club. I think it’s important to point out this recent change as they affect some of the third party tools that I feature on the blog. In a nutshell, the change is that instead of tools being able to constantly get up-to-date data from the CSV file right at release time, it is now only updated once every minute. For those that don’t know what a CSV file is, it is simply a text file which includes organized data - in this case all of the available loans. You can read other forum member’s thoughts here. What does this mean for third party tools? In the case of P2P-Picks - a lot.

There has been quite the discussion brewing over on the Lend Academy Forum about a recent change from Lending Club. I think it’s important to point out this recent change as they affect some of the third party tools that I feature on the blog. In a nutshell, the change is that instead of tools being able to constantly get up-to-date data from the CSV file right at release time, it is now only updated once every minute. For those that don’t know what a CSV file is, it is simply a text file which includes organized data - in this case all of the available loans. You can read other forum member’s thoughts here. What does this mean for third party tools? In the case of P2P-Picks - a lot.

I went on vacation last week, but my Lending Club account didn’t (How I invested $1,000 in less than 1 week)

It wasn’t until last week until I truly appreciated the fact that my account was fully automated. I used to think automation wasn’t necessary. After all, I’m a software developer by trade and usually have my laptop within reach during the 4 pm or 8 pm CST note release times. However, last week I went on a road trip to South Carolina and camped along the way down south - not conducive to managing a p2p lending account that isn’t automated. I tried to coordinate a significant amount of capital (it’s all about perspective people) being invested while I was gone and see how long it would take to invest. [Read more...]

It wasn’t until last week until I truly appreciated the fact that my account was fully automated. I used to think automation wasn’t necessary. After all, I’m a software developer by trade and usually have my laptop within reach during the 4 pm or 8 pm CST note release times. However, last week I went on a road trip to South Carolina and camped along the way down south - not conducive to managing a p2p lending account that isn’t automated. I tried to coordinate a significant amount of capital (it’s all about perspective people) being invested while I was gone and see how long it would take to invest. [Read more...]

BlueVestment Video - Free Third Party Tool for Lending Club

When it comes to investing in social lending, it is no secret that I’m a fan of automated investing. In our first video, I featured LendingRobot and today I’m featuring a free tool called BlueVestment. I’ve been using BlueVestment paired with p2p-picks.com for about a month now. BlueVestment allows you to select your own filters, but it also connects picks from Bryce’s credit models over at p2p-picks. It takes some time to get setup, but once you create the accounts it really is completely hands off.

If you want more information, check out our Q & A with Nathan (Owner of BlueVestment) here or feel free to ask questions in the comments.

P2P Lending Diversification and Portfolios

There are many strategies in investing in P2P Lending, several of which were outlined in our last series of posts by New Jersey Guy and his experience with FOLIOfn. You should note that those 3 strategies were just a taste of the secondary market and there are some very dedicated people out there who are trying out all sorts of strategies. Just hop on over to the Lend Academy Forum and I’m sure others could teach you a thing or two. I’ve heard New Jersey Guy mention diversification within peer to peer lending investments several times and it is something I now realize I knew nothing about. [Read more...]

Peer to Peer Lending Automation - The Key to Investing in Lending Club

Over the last couple of months, we have featured 3 tools for automating your investments in Lending Club. Before the question and answer sessions we posted, my process for my investing was completely manual. Brian was investing manually as well and he actually setup a third party mobile app to send him notifications just before Lending Club releases notes. Even with my relatively small account, I was missing feeding times and had available cash just sitting in my account pretty often. Automation tools are starting to mature and I decided that it was finally time for me to try them out and hopefully help others who were considering automation. [Read more...]

Q & A with BlueVestment - FREE Automated Investing Tool for LendingClub

BlueVestment is a third party tool for automation with LendingClub. Recently, they have made their product completely free for investors. Not only does the tool allow you to select your own custom filters, but it also ties into P2P-Picks for loan picking - a feature that I’m currently using. (If you haven’t heard of Bryce Mason from P2P-Picks, you may also be interested in the podcast he did with LendAcademy here)

BlueVestment is a third party tool for automation with LendingClub. Recently, they have made their product completely free for investors. Not only does the tool allow you to select your own custom filters, but it also ties into P2P-Picks for loan picking - a feature that I’m currently using. (If you haven’t heard of Bryce Mason from P2P-Picks, you may also be interested in the podcast he did with LendAcademy here)

Nathan from BlueVestment was nice enough to participate in our third part in a series of posts about third party tools. If you have any questions for Nathan, please feel free to post in the comments.

LendingClub - The easy way to get invested

When starting investing in LendingClub many individuals choose one of of these options for getting fully invested.

#1 Used the LendingClub predetermined portfolio which gives you an estimated return

or

#2 Combing through notes based on filters and hand picking notes out.

There is certainly nothing wrong with either of these options, but what if there was an easier way? I learned about both InterestRadar and P2P-Picks and decided to sign-up. Currently, InterestRadar offers a 30 day free trial, a $9.99 monthly subscription or $59.99 for a one year subscription. Alternatively, if you have less than $10,000 in your account (like me), you can email them at [email protected] to receive a limited-time discount. P2P-Picks is still in beta so for the time being you can sign-up and enjoy free access.

P2P-Picks is very straight forward with two options to invest:

- Loss Minimizer (Loans with the lowest modeled risk, regardless of interest rate.)

- Profit Maximizer (Loans expected to have the biggest reward for the risk.)

Simply select the option you want to go with, choose the note size and press go. You will want to make sure you are logged into LendingClub so the notes can appropriately to your oder.

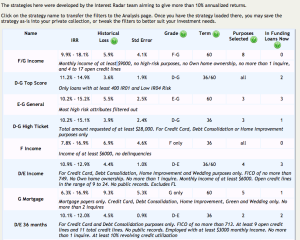

InterestRadar has several different features, but for simplicity sake we will focus on the Strategy Shop for now. There are different strategies listed to choose from, some of which are shown below:

Simply click on the strategy you are interested in (provided there are available loans) and you will be taken to a screen where the notes are listed. From here you can view some of the details and invest in the notes if you are interested. One of my favorite columns is the LC Hype/IR Hype which allows you to get an idea of the popularity of a note. If you don’t see notes in the desired strategy, try looking just after 6 AM, 10 AM, 2 PM and 6PM Pacific Time. There is much more available with InterestRadar, but this should at least get started.

I currently use both of these tools to find loans, but then I review them individually before actually invested. I have 2 separate portfolios setup for each product so I will be sure to keep the results up to date.

What is your favorite tool or favorite feature of a particular tool? Interested in us featuring your third party tool? Contact us!