There are many strategies in investing in P2P Lending, several of which were outlined in our last series of posts by New Jersey Guy and his experience with FOLIOfn. You should note that those 3 strategies were just a taste of the secondary market and there are some very dedicated people out there who are trying out all sorts of strategies. Just hop on over to the Lend Academy Forum and I’m sure others could teach you a thing or two. I’ve heard New Jersey Guy mention diversification within peer to peer lending investments several times and it is something I now realize I knew nothing about.

I think a lot of investors when hearing this would immediately think of not just investing in one of the platforms, but rather in Lending Club and Prosper equally. Some likely think about diversifying in lower grade notes along with the higher returning - high grade notes. Of course, there is always making sure you have enough notes (LendingRobot’s Diversification Graph). These are all valid ways to diversify, but the secondary market really opens up many more ways to diversify.

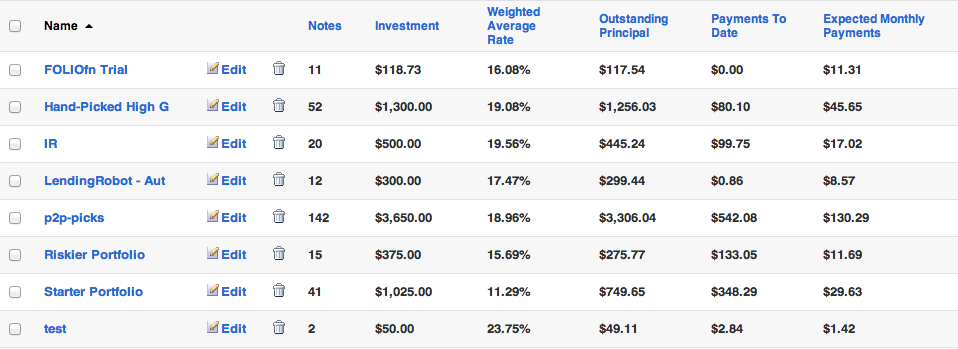

In some ways, using different filters and how the picks are chosen is a way to diversify. Thus, I thought it would be interesting to look at all of my portfolios since I started investing.

Here is a quick key due to the ones that got cut off or might be confusing to some readers:

- FOLIOfn - secondary market notes

- Hand-Picked High Grade - Portfolio I created once I realized the potential for higher returns

- IR = InterestRadar (These were hand invested at feeding times using their ranking)

- LendingRobot - Automation Our coverage here Signup/Automate yourself: here

- P2P-Picks - Some of these are automated with BlueVestment - others were handpicked on P2P-Picks directly

- Riskier Portfolio - Part of my starter portfolio where I began to select slightly riskier notes

- Starter Portfolio - Pretty self explanatory, my very first portfolio

- Test - Who knows

You can clearly see how my strategies have evolved over time and I think a lot of P2P lending investors go through several transitions as they continue to learn.

How I am Investing in Peer to Peer Lending Today

This obviously changes fairly often as new tools are released and I decide to try them to benefit other investors. However, right now I’m giving FOLIOfn a try. After reading and learning so much about FOLIOfn - I just couldn’t resist. As a fallback, I have a threshold on my account with BlueVestment set to $100 so I never really have much more than that available in my account. I do not use the filter feature, but simply use P2P-Picks profit maximizer - top 25%.

My weighted average interest rate is still fairly high at 17.71% and my average age of my portfolio is 5.1 months. So am I diversified? Probably not as much as I could be, but I couldn’t be happier with my returns so far.

Share your thoughts about your portfolio, strategies or diversification in P2P lending in the comments!

One thing of note is you will have trouble comparing your strategies with such small portfolios. In a conversation I’ve had with Bryce (P2P-Picks), you really need to get about 100 per portfolio to have reasonable comparisons.

Best of luck with the future investments through BlueVestment and P2P-Picks. Out of curiosity, are you paying an investment fee for the P2P-Picks? I know BlueVestment no longer charges a fee, but am not aware if Bryce changed his policy.

Agreed that I won’t really be able to compare strategies and I’m ok with that. P2P-Picks is currently free and I believe Bryce plans to leave it that way as long as it doesn’t require too much of his time. Basically if you want to automate you just sign up for your P2P-Picks account and link it through BlueVestment. I’ve been pretty happy with the results (video coming soon).

I like where you are going with this although I never automate my investing. I am too concerned about the security of my info. Don’t most of them screen scrape?

I am relatively undiversified according to many but using standard credit techniques means I am hopeful that I am accounting for these risks already on each loan I choose to buy. Keep up the good work

Nathan says

Hi Stu,

My BlueVestment service uses the API whenever it can but we screen scrape to get information that the API doesn’t/won’t provide. There are serious concerns with the limitations of the LC beta API. They really don’t provide enough or even basic capability other than to invest (and it’s limited at that). LC does provide some RESTful edges on their public site than can be utilized as well in a safe and secure manner as long as the consuming application is architected appropriately.

Saying “screen scraping” is (IMHO) over generalizing. BlueVestment uses the fastest methods that are available in order to securely and correctly execute trades on behalf of our customers.

Nathan

BlueVestment

Stu, security is definitely a concern from an account perspective and you really just have to decide whether you’re willing to put that trust into the third party tools. The hope is that they have spent some time on this aspect of the service, but obviously nothing is foolproof (Target data breach among many others come to mind) If you give it some time these tools will continue to mature (as p2p lending and their apis will as well) and that may ease your concerns. From my interaction with the people behind the tools we have featured on the blog, it sure seems like they have done their due diligence when it comes to security.