It has been awhile since I’ve had a post outlining my returns with p2p lending and my plan is to be more consistent with these posts in the future. I want to preface this with the fact that my Lending Club notes are still not seasoned which means my returns below are not an accurate representation of what they will be. In fact, I have seen little progress in the average age of my notes as I continue to add funds to my account. [Read more...]

Brian’s Portfolio (10/2013)

At the end of October my portfolio had 79 notes in it. My average rate jumped climbed to 19.03% due to taking on even more high interest notes.

[Read more...]

Ryan’s Portfolio (10/2013)

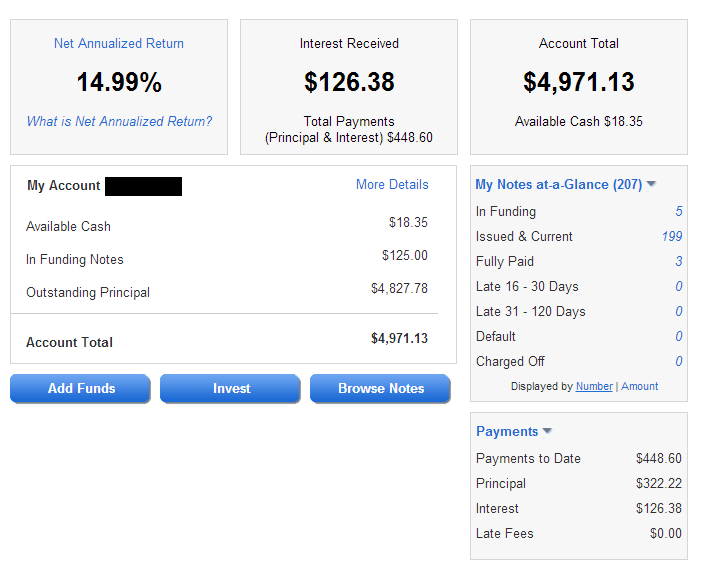

Yes, it has been a long time since I’ve had a portfolio post, but rest assured my account is alive and well (growing too). I’m about 6 months in from when I first started purchasing notes and I still have yet to see a note go late (no notes currently in grace period notes either!).

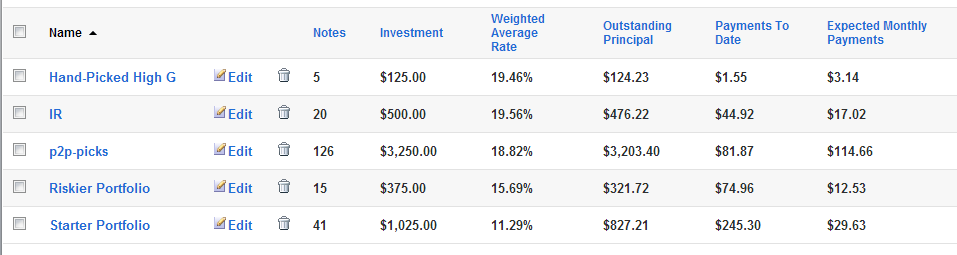

Below you will see my portfolios which will better help you understand my returns. When I first started, I did not pick higher grade notes in order to maximize my returns. Eventually, I started digging more into the third party tools and used interestradar and p2p-picks almost exclusively to pick my notes. Now I am back to hand-picking high grade notes for now.

Finally, here are my returns:

I am still very happy with the returns and will continue to add to my account.

Brian’s Portfolio (9/2013)

As of the first of September my portfolio had 55 notes in it. My average rate jumped climbed to 18.44% due to taking on even more high interest notes.

[Read more...]

Brian’s Portfolio (8/2013)

As of the first of August my portfolio had 44 notes in it. My average rate jumped up to 17.14% mostly due to taking on a lot more D and E grade notes.

[Read more...]

Brian’s Portfolio (7/2013)

As of the first of July my portfolio has picked up a little bit of speed. I now have 36 notes purchased (all at $25) and am looking at an average rate of return of 15.62%

[Read more...]

Ryan’s Initial Portfolio (June, 2013)

I began my investment into Lending Club in March 2013. At that time I had anticipated funding my account with $2500 to take advantage of the refer a friend credit (which I highly recommend). I have started to set up automatic payments of $50 per month and may continue to increase my contributions. I currently have two portfolios, one to track riskier notes and the other to track mostly A,B and C grade notes. It will be interesting to compare both of our portfolios and see where the most cents can be made.

My current breakout is as follows as of June 5th, 2013:

Available Cash: $0.39

In Funding Notes: $75.00

Outstanding Principal: $1,212.91

Accrued Interest: $10.29

Account Total: $1,298.59

My Payments as of June 5th, 2013:

Principal: $62.09

Interest: $14.19

Total Payments: $76.28

Net Annualized Return: 11.41%

My Notes at-a-Glance:

In Funding: 3

Issued & Current: 50

Fully Paid: 1 (Someone paid off their grade E loan (21.49% interest rate) after one payment)

Late 16 – 30 Days: 0

Late 31 – 120 Days: 0

Default: 0

Charged Off: 0

All of my notes are at $25.

A Notes: 10

B Notes: 29

C Notes: 8

D Notes: 3

E Notes: 0

Brian’s Initial Portfolio (June, 2013)

I should start off by posting the current statistics for my portfolio so that we can appropriately see the growth over the coming months. I’ll tell you now that there’s relatively not much in there (less than $1,000) but that just makes it all the more relevant to you, a normal working person. If you came here to learn about Lending Club and how to make some decent returns then you’re probably not going to invest more than $1,000 right off the bat anyways. You’re a hard working individual who doesn’t want to throw money into something they’re not sure of… that’s something we here completely understand.

[Read more...]